Key Takeaways

- The SEC will be establishing a regulatory task force, which will be led by Crypto Mom, Hester Pierce.

- The SEC is hosting a crypto roundtable on 21 March to discuss the future of digital asset regulation within the country.

- The agency has dropped many enforcement actions against companies like Kraken as its Task Force comes into play.

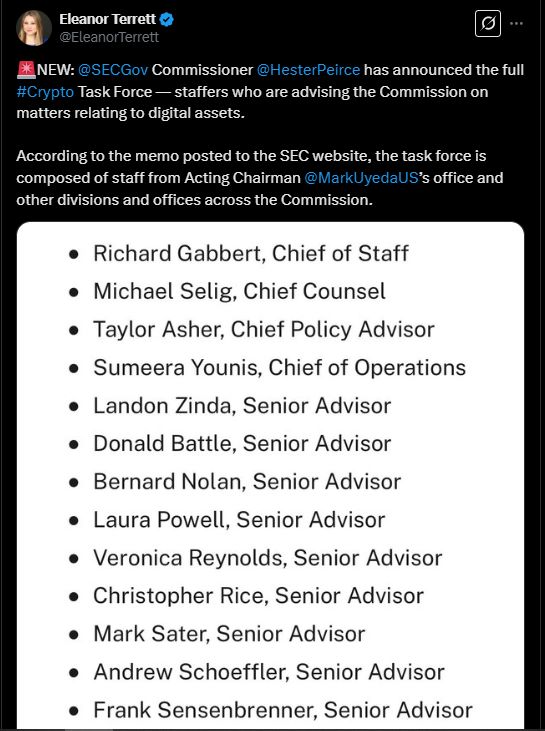

- The crypto task force includes some major players across industries, like Michael Selig and Sumeera Younis.

The US SEC has officially announced its Crypto Task Force.

This initiative brings together a mix of veteran agency officials and digital asset specialists, and the future of crypto in the US looks as bright as ever.

This move points towards a shift from the SEC’s usual “enforcement first” approach to a more structured way of tackling crypto regulation.

Here are some of the major details.

Why the Task Force Formed?

Per a statement from the agency, the crypto task force will be led by Commissioner Hester Pierce, who is a well-known crypto advocate and is even nicknamed the “crypto mom.”

The team will comprise experts across the legal and policy industries, along with blockchain experts.

It is expected to refine the SEC’s stance on digital assets and engage with industry experts for a more constructive way forward.

This development comes amid increasing pressure from around the world for a move from the “enforcement first” approach to regulation in the US.

Per speculation, a more transparent framework for crypto in the US is underway, and the future seems bright.

The Initiative’s Leaders and Members

Under the leadership of Commissioner Hester Peirce, the crypto task force is expected to bridge the gap between the traditional securities laws and the digital asset space, which is still in development.

Some of the key figures in this newly formed group include Richard Gabbert, a longtime SEC official and Peirce’s former counsel.

Gabbert is expected to serve as chief of staff, along with Michael Selig as chief counsel.

Selig was a former partner at Willkie Farr & Gallagher and was responsible for advising firms on issues of crypto regulation.

He was responsible for advising companies facing regulatory action from both the SEC and the Commodity Futures Trading Commission (CFTC).

Other key members include Taylor Asher and Landon Zinda as chief policy advisor and senior advisory, respectively.

Asher was a former advisor to Commissioner Mark Uyeda, while Zinda formerly worked with the Coin Center.

Finally, Veronical Reynolds and Bernard Nolan are expected to serve as legal advisors.

Reynolds is a legal specialist in NFTs and metaverse regulations who formerly worked at Baker Hostetler LLP, while Nolan formerly worked at the SEC’s Division of Investment Management.

The inclusion of these professionals from several sectors shows that the SEC is taking a balanced approach with a mix of legal and digital asset experts.

A Shift Away from Enforcement-First Regulation

The SEC used to be known for being an “sue first, ask questions later” agency under the leadership of its former chair, Gary Gensler.

Gensler treated most cryptocurrencies as securities and launched lawsuits against numerous crypto forms throughout his tenure.

However, the new crypto task force has been put in place and is working towards a shift to a more engagement-driven regulatory model.

This change aligns with the promises of Donald Trump during the presidential campaigns, in which he promised to reduce regulatory hurdles for the crypto industry.

Notably, the SEC has dropped several enforcement actions against the crypto space lately, including the ongoing lawsuit against Kraken.

SEC’s First Crypto Roundtable

As part of its new strategy towards crypto regulation, the SEC is also set to host a roundtable discussion on 21 March.

This discussion will take place at its Washington, D.C. headquarters and is titled “How We Got Here and How We Get Out—Defining Security Status.”

It is expected to focus on classifying digital assets under existing securities laws and could be the final step towards fairer crypto laws in the US.

The roundtable discussion marks the beginning of a wider move called “Spring Sprint Toward Crypto Clarity.”

It is expected to include multiple discussions involving clear guidelines for the digital asset space.

What This Means for the Crypto Industry?

The formation of this crypto task force and the upcoming roundtable show a more collaborative approach to the past of the SEC.

The SEC appears to be more willing to involve industry experts in its decisions, along with legal and policymakers.

While there aren’t much specifics available at the time, the crypto task force shows that the agency is focusing on more practical frameworks rather than continuing with old ones.

The SEC’s dropping of multiple enforcement actions also shows that it is moving away from the past, where it went after multiple companies like Uniswap, OpenSea, Ripple, Binance, and Coinbase, to mention a few.

Figures like Michael Selig and Landon Zinda being on board also mean that the agency is favoring more crypto-friendly policies.

The crypto market could be on the verge of a “compliance and innovation” based future.

A New Era for Crypto Regulation?

The SEC’s stance on crypto remains a topic of debate, however, with no clear facts being available at press time.

However, the formation of the crypto task force and the agency’s openness to engage with the community show that it is willing to move on from the past.

Its compilation of crypto and legal experts shows that it is laying the groundwork for a more welcoming environment, and the success of the crypto task force remains to be seen.

If the ongoing moves are well executed, this could be the beginning of a fairer and more predictable future for crypto within the US.