SEC Collects $8.2 Billion in Fines in 2024: Fair Justice or Overreach?

The US Securities and Exchange Commission has collected a record-breaking $8.2 billion in fines so far in 2024, the largest amount the commission has collected in one year. The achievement is primarily due to the commission imposing an unprecedented $4.47 billion fine on TerraForm Labs, the largest penalty the SEC has ever enforced in its 90-year history.

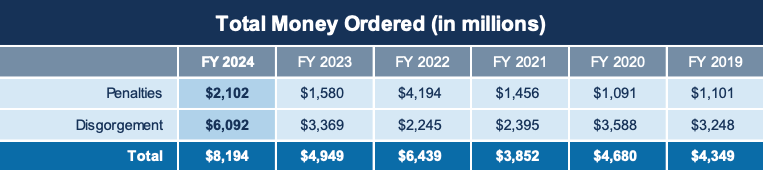

Among the collected fines this year, $6.1 billion was from disgorgement, i.e., the recovery of profits is asked to surrender those, and the other $2.1 billion was a penalty.

The heavy fine appears to have negated its intended purposes, as many argue it does little to help the millions who lost thousands in their wallets when the Terra LUNA ecosystem collapsed.

Note: The SEC has six departments, of which the Department of Enforcement oversees penalties, sends Wells Notices, imposes fines, and fights cases.

SEC’s Previous Fine Collections

The SEC had never collected such large fines in the last six financial years.

This year’s fines were 62% higher than last year’s. Last year, these collections were barely $4.95 billion, of which $1.6 billion was penalties and the rest was disgorgement.

Even those collected in the financial year 2021-22 were only $6.5 billion. This consists of $4.2 billion in penalties and the rest under disgorgement.

As a median figure, the SEC collected around $4 billion to $5 billion each year. This started to change in the financial year 2022 when the agency began targeting large crypto companies.

Terra LUNA: A Catastrophic Collapse

The Terra LUNA ecosystem exemplifies a once-promising blockchain project initiated by its founder Do Kwon, whose volatility and risks eventually became the embodiment of the cryptocurrency industry. Its primary offering was an algorithmic stablecoin, TerraUSD, which maintained a 1:1 peg to the US dollar via an intricate mint-and-burn process in tandem with its sibling token, LUNA.

The system collapsed in May 2022, sending UST into a “death spiral,” losing its dollar peg and driving LUNA almost to zero.

More than $60 billion of market capitalization vanished overnight, devouring life savings, investments, and trust in algorithmic stablecoins. The incident quickly propagated through the larger cryptocurrency sector, leading to bankruptcies and an intense crackdown on regulation.

Historic Fine Sets Off Controversy

The $4.47 billion fine dwarfs any fine the SEC has ever issued. Its devastating message to crypto firms in particular and others involved in misleading investors and breaching securities law is grave. However, despite the SEC’s stubborn attitude, the fine is scorned for lacking an investor restitution-focused approach.

Many believe that such a large amount of money could have bailed out millions of investors from the Terra fiasco. Another radical opinion is that some part of this sum could have been used to re-peg TerraUSD (UST) and restore the much-small ecosystem. Rather than this, the fine could have given immediate relief to those who were affected by the Terra saga by subsidizing investor recovery or ecosystem stabilization.

Are Kwon and TerraForm Labs Really Bankrupt?

Other questions also arise regarding the handling of funds. Why did Do Kwon, co-founder of TerraForm Labs, seek bankruptcy in the United States if he had substantial money reserves? The $4.47 billion fine to the SEC is suspect of the actual extent of Kwon’s financial reserves.

With such funds available, why was Kwon claiming insolvency and avoiding direct engagement with restitution efforts?

Finally, some critics argue that the SEC’s duty was to scrutinize Kwon’s personal and corporate assets in more detail to conclude the settlement. If the agency knew of the presence of substantial funds, why not require a full audit to identify the definite amount of assets within Kwon’s control?

Such an inquiry could have uncovered additional resources that might have been directed toward compensating investors or supporting efforts to stabilize TerraUSD (UST) and the broader ecosystem.

A Misstep in Regulatory Strategy?

Critics argue that the deterrent effect could have been paired with proactive measures to address investor losses. Penalties on TerraForm Labs, without an avenue for restitution, risk alienating investors and developers who will view the crypto space as over-hostile and punitive.

The Road to Investor-Centric Regulation

In other notable cases, such as the collapse of the FTX cryptocurrency exchange, fines are combined with recovered assets to ensure investor reimbursement. For example, in FTX’s bankruptcy case, its administrators worked to recover and return assets to creditors and investors.

In the Terra case, however, the SEC’s approach has been markedly different. The entire fine was put directly into the agency’s treasury – and no clear way for investors to be compensated.

On January 20, 2025, Donald Trump will assume office once again, following a historic election victory. His return could signal a shift in the regulatory landscape, with a renewed focus on economic growth and investor protection—hallmarks of his previous administration.

This dynamic is compounded by Gensler’s departure as SEC Chair, which coincides with the administration. Critics of Gensler also point out that he has been aggressive in shutting down crypto firms, perhaps too aggressive to foster the need for tangible investor outcomes. With new leadership at the helm, the SEC might be likely to strike a more even balance in such conduct, suggesting enforcement action balanced with recovery mechanisms.

Many suggest that had Trump been in power during the TerraForm Labs case, a more investor-centric measure might have been taken. A percentage of the $4.47 billion could have been used to ensure investors’ compensation or stabilize the Terra ecosystem with a lower market cap. The approach would balance accountability with further efforts to rebuild investors’ trust in the crypto space.

Conclusion

The $4.47 billion fine imposed on TerraForm Labs marks a milestone in the SEC’s enforcement history, but it also exposes gaps in how regulators have been dealing with investor losses. While the fine has helped the SEC record collections, it’s done little to ease the financial pain of those who bore the brunt of the Terra LUNA collapse.