Key Insights

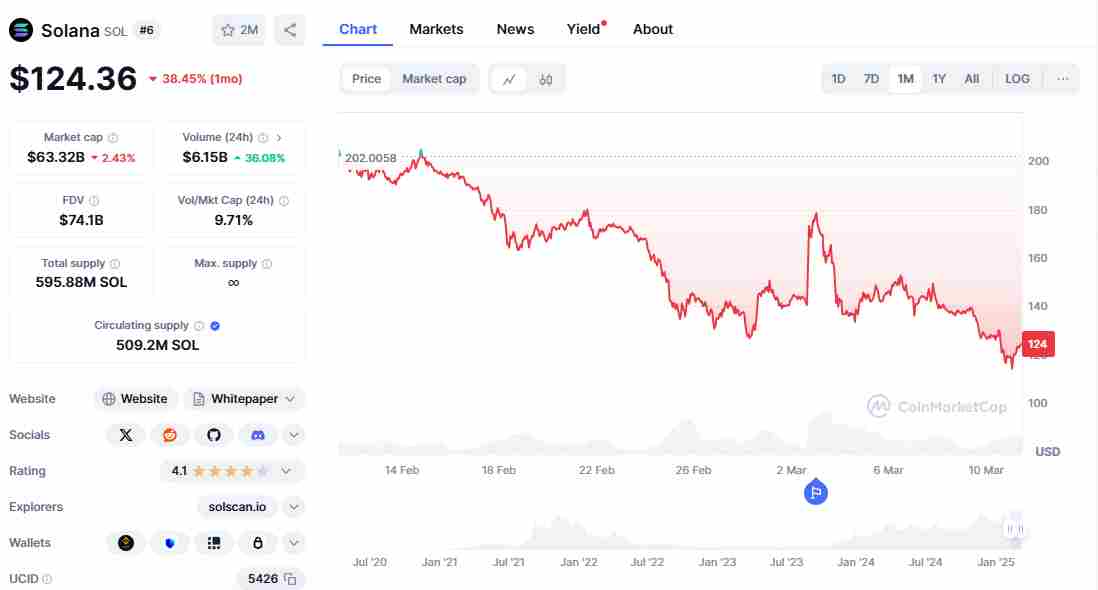

- Solana (SOL) has been in a massive dip lately, due to the general market’s decline.

- Solana’s woes began when it dropped below the $200 support level, causing a retest of the $112 zone.

- Leveraged Solana traders have felt the heat lately, with $47.55 million worth of trades wiped out in just 24 hours.

- Investors are advised to be cautiously optimistic about the crypto market.

- If we see a reclaim of the $151 and $185 resistance levels, it could signal a new bullish wave and cause a rebound towards $200

Solana has taken a massive hit over the last month, after dropping 35% to as low as $112 late on Monday.

This stands as the cryptocurrency’s lowest in five months and has sparked concern among investors:

The buying pressure in the crypto space has turned weak, and outflows continue to trickle out of the crypto space despite the technical buy signals on its charts.

Here’s what’s going on with SOL and what to expect.

Solana and its Weak Market Participation

The wider crypto market has been through a rough time over the last two weeks, contributing to Solana’s struggles.

While some traders see the ongoing price dip as a prime buying opportunity, others continue to worry that the sell-off might continue and push prices even lower.

So, what’s next for Solana? Let’s break it down.

Solana’s woes began when it dropped below the $200 support level. This decline triggered further downside for the cryptocurrency, leading to the retest of its current lows.

Since the start of 2025, SOL has now lost nearly 29% of its value, and its market cap is dangerously close to the $60 billion mark.

The current market indicators show that market participants are cautious, especially with the red candlesticks that continue to pop up daily.

One of the major concerns with SOL has been its sharp decline in trading volume.

CoinMarketCap data shows that this metric sits at around $61.5 billion, which is a 36% increase over the last day but a 61% decline over the last month.

Adding to the bearish sentiment, Solana’s BTC pair has plunged to a two-year low, marking its weakest performance in this cycle. This further signals a lack of confidence among traders and investors in the near-term recovery of SOL.

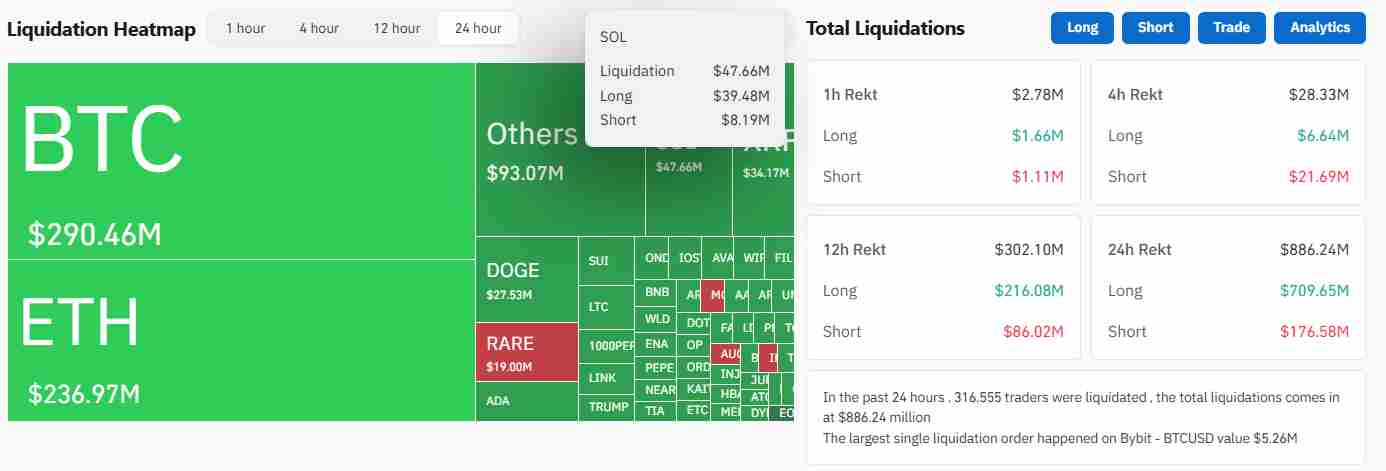

Liquidation Wipeout—$47.5 Million Gone in 24 Hours

Leveraged SOL traders have felt the heat lately, with $47.55 million worth of trades wiped out in just 24 hours.

Most of these trades were long positions, worth the majority at around $39 million. This indicates that traders have been betting on a price rebound and were caught off guard by the crash towards $112.

Meanwhile, Open Interest (OI) has been on the decline as well, with a current value of $3.83 billion.

This, combined with the weak accumulation patterns, shows that the anticipated rise might not be close by.

Just a week ago, the cryptocurrency’s open interest peaked at around $5.31 billion during the first announcement of the US strategic crypto reserve by Donald Trump.

However, the decline that followed erased SOL’s gains by around 20% as more and more traders continued to panic sell.

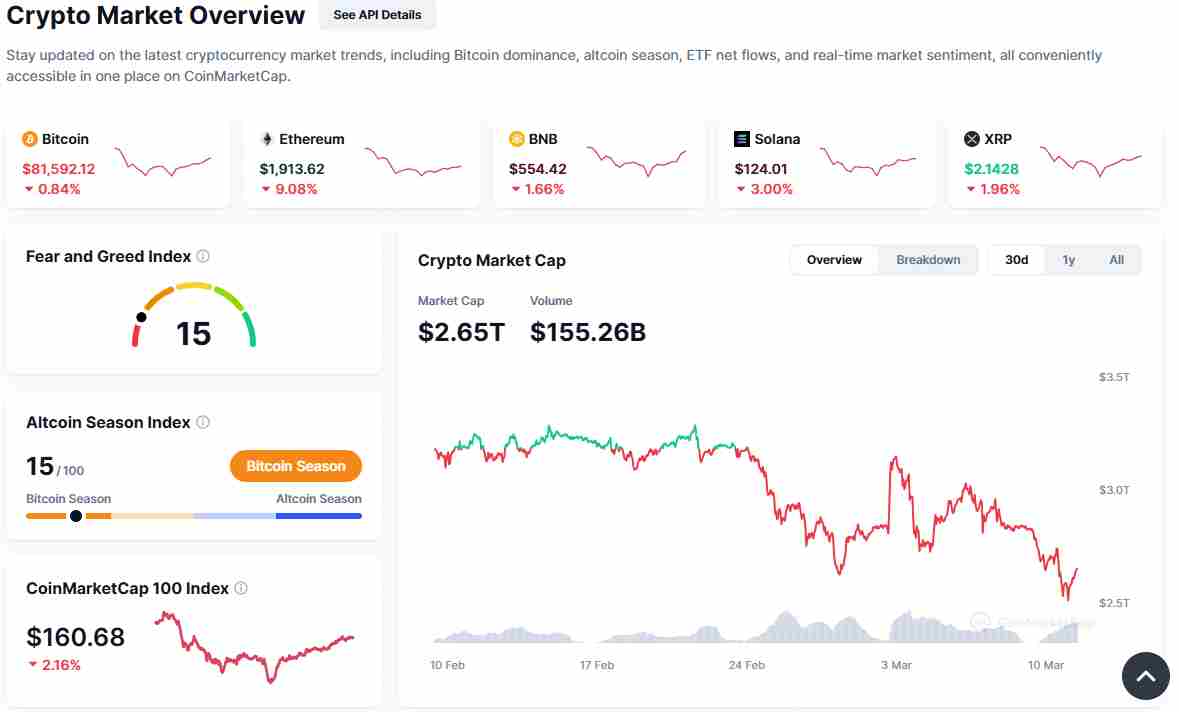

The Broader Market’s Impact on Solana

Solana’s ongoing decline is not an isolated event. The rest of the crypto market is currently facing bearish headwinds as well, with the global crypto market cap sitting at around $2.65 trillion.

This represents a near-5% decline across the market in the last day, with Bitcoin down by around 5% and Ethereum following with a 6% decline.

The recent White House summit and the crypto reserve announcement on 7 March were expected to boost sentiment.

However, the news had the opposite effect, causing a crash on major cryptocurrencies across the market.

Despite these trends, massive price crashes on SOL have always attracted investors looking for discounted prices.

At the same time, investors are advised to be cautiously optimistic about the crypto market.

Could Solana Retest $100?

Many analysts are now questioning whether SOL could drop further and retest the psychological $100 level.

So far, technical indicators are presenting mixed signals. On one hand, Solana appeared to have bottomed around the $118 Fibonacci level. However, it soon shocked investors by trekking even further downwards to the next key support zone around $112.

The Relative Strength Index (RSI) on the daily chart has entered oversold territory, indicating that a bounce could be possible soon.

However, a failure of SOL to reclaim the $118 zone could lead to a drop below $112 once again, and towards $103.41.

In essence, Solana is not out of the woods yet when it comes to a retest of the $100 mark.

In contrast, if we see a reclaim of the $151 and $185 resistance levels, it could signal a new bullish wave and cause a rebound towards $200.

Can Solana Recover?

Despite the short-term headwinds, Solana still has strong fundamentals. The network continues to attract institutional investment, even despite a spot Solana ETF not being confirmed yet.

Many analysts believe that its addition to the US’ crypto reserve plans could be a source of regulatory traction for the cryptocurrency in the future.

Additionally, Bitcoin appears to be consolidating, and investors tend to rotate funds into altcoins when this happens.

As a result, Solana could be primed for renewed demand.

At the same time, for a strong recovery to occur, Solana needs to overcome its liquidity challenges and restore investor confidence quickly.

Buy the Dip or Stay Cautious?

Solana’s price presents both risk and opportunity at this point.

While technical signals point towards a buy verdict, the weak buying pressure and the sluggishness of the crypto market as a whole could be a major source or concern.

If Solana fails to hold key support levels, a retest of the $100 mark remains possible.

On the other hand, if we see a reclaim of some key support levels and the general market conditions improve, Solana could be ready to stage a comeback.

Investors should remain cautious through it all and monitor aspects of the market like sentiment, trading volume, and Solana’s response to wider crypto trends.