Key Takeaways

- Donald Trump recently signed the much-awaited crypto reserve bill into law.

- However, this move had an underwhelming impact on the crypto space.

- Investors were disappointed to find that the bill has no plans to drive demand by purchasing new Bitcoin.

- Instead, the bill is simply repositioning Bitcoin and other cryptocurrencies that the US government already had.

- Despite the ongoing market decline, there are still strong signs of investor interest in dip buying.

The crypto market crashed hard over the last 24 hours. This decline came after President Donald Trump signed an executive order establishing a strategic Bitcoin reserve and a digital asset stockpile.

While this announcement initially sparked interest, the lack of concrete purchasing plans from the government left many investors disappointed.

As a result, Bitcoin and most of the altcoin market slid downward.

Bitcoin’s Reaction to the Executive Order

Bitcoin dropped sharply soon after the news broke on Thursday, with the cryptocurrency falling to as low as $84,688.

By early Friday, the cryptocurrency had stabilized somewhere around $88,949, according to data from CoinMarketCap.

The broader crypto market also struggled, with altcoins like Ethereum, XRP, and Solana still trading in the red.

So why did this crash happen?

The main reason for this crash was that the executive order did not include any immediate plans for the US government to buy more Bitcoin.

Instead of establishing a national reserve by buying more of the cryptocurrency, said stockpile will only contain Bitcoin that the Federal government already possessed.

Most of this Bitcoin came from past law enforcement seizures, and has no bearing on new Bitcoin adoption by the US government.

The revelation dampened investor hopes for a rally and in turn caused the crash.

The White House Clarifies Its Bitcoin Strategy

David Sacks, the White House crypto and AI czar, took to Twitter to outline the administration’s approach to this strategic reserve.

He confirmed that the reserve will be built using assets forfeited in criminal and civil proceedings.

Furthermore, the US federal government does not intend to use taxpayer money for more acquisitions.

At the moment, the US government holds over 198,000 bitcoins, according to blockchain analytics platform Arkham Intelligence.

This stash, worth approximately $17 billion, will also be added to other cryptocurrencies seized through similar processes, like Ethereum, Solana, XRP, and Cardano.

However, there are still no plans to actively purchase more assets beyond those the government already had.

Sacks noted that the Secretaries of Treasury and Commerce have been authorized to explore “budget-neutral strategies for acquiring additional Bitcoin.”

Put simply, this reserve is expected to be established with no input from taxpayers.

This lack of immediate investment from the US government was a major source of disappointment for traders who expected a stronger commitment to Bitcoin and was responsible for the crash.

Investor Sentiment and Market Reactions

Bitcoin tanked by as much as 6% soon after the announcement, to a fresh new low of $84,900 before rebounding slightly to $87,700 by Friday morning.

Other cryptocurrencies also dropped, including Ethereum, which dropped 6% to $2,156.

Solana and XRP also fell 5% and 1.5%, respectively, with Cardano and Dogecoin suffering the most and losing 10%-7%, respectively.

According to Edul Patel, CEO and co-founder of Mudrex, in an interview with Money Control, the lack of government buying activity played a major role in investor concerns about future demand.

“Investors expected fresh capital” he explained, “but the White House simply wants to reorganize existing holdings without creating new demand.”

Economic Uncertainty Weighs on Crypto

Beyond the executive order, there have also been a few broader economic issues when it comes to the crypto market’s struggles.

For example, the market’s broader economic conditions have also contributed to the decline.

There are ongoing concerns about inflation and trade tensions, all of which have overshadowed the excitement around the US government’s interest in crypto.

According to JP Morgan analysts, the crypto market is showing no signs of a strong movement to the upside in the near term.

Moreover, Bitcoin’s inability to hold the $90,000 zone has led some analysts to warn that a drop towards the $70,000 zone could still be in the cards—especially if the sentiment weakens further.

Was Trump The Mastermind of This Crash?

Through it all, Donald Trump has positioned himself as an advocate for the crypto industry.

He has made bold promises about turning the U.S. into the “crypto capital of the planet.”

This is one of the first sources of confusion with the executive order, which was initially seen as the first step towards that vision.

However, its immediate impact has been underwhelming, and the crypto market is showing no signs of a comeback.

While some industry leaders are viewing the Bitcoin reserve as a positive development regardless, others believe that it lacks what it takes to drive institutional confidence.

According to Peter Schiff, a well-known crypto skeptic, the move is a “pump and dump” tactic that does little to support Bitcoin in the long term.

Schiff blames Trump as the mastermind of the crypto market’s woes and says that the US president “allowed his presidency to be hijacked by the frauds in the crypto industry.”

What’s Next for Bitcoin and the Market?

Despite the disappointment, many analysts are still optimistic.

According to Patel with Money Control, “Bitcoin is on a recovery trend after finding support at $84,700.”

In essence, the quick recovery of the cryptocurrency from the Thursday slump shows that investors still see value and are interested in buying the dips.

The market’s participants will continue to watch what happens next, especially with how the US government might take a more proactive approach to crypto buying in the future.

In addition, the inflation data and central bank policies continue to make great cases for the US government buying more crypto for its stockpile.

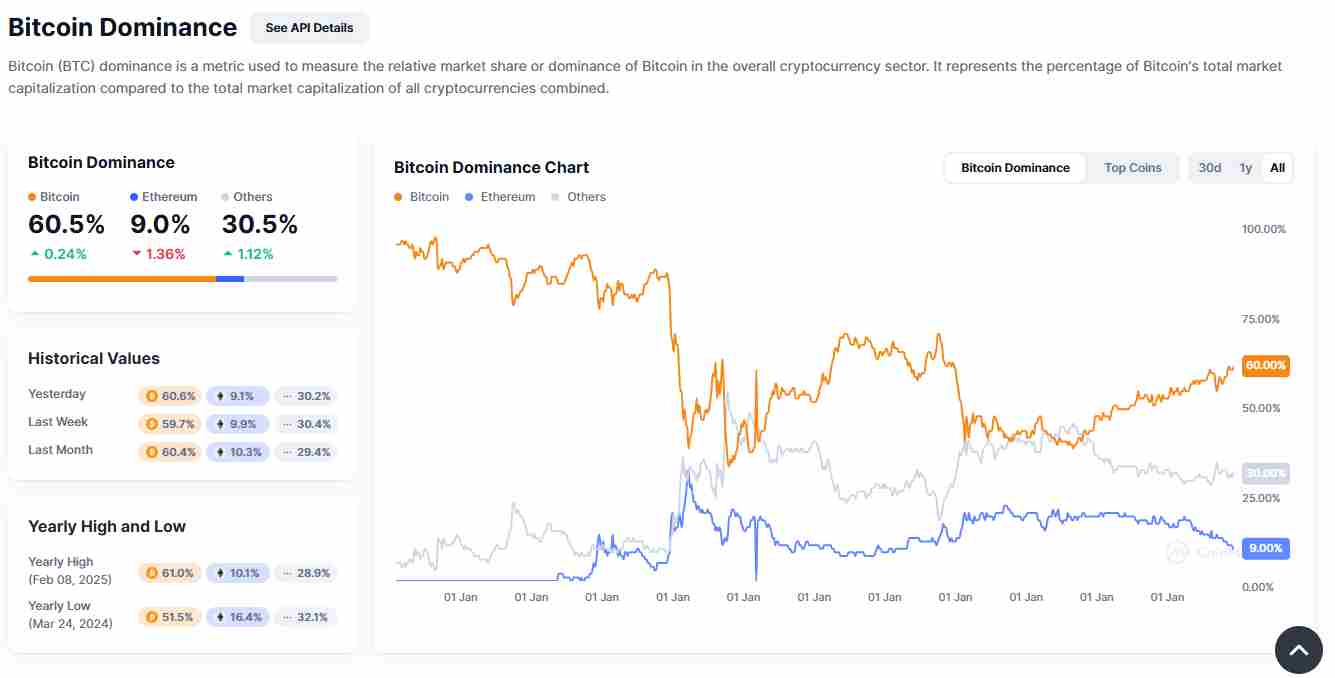

For now, Bitcoin is holding on to its dominance level around the 60.41% range.

However, its short-term trajectory depends heavily on how much volatility the next few days bring and how well traders digest the newer updates on the cryptocurrency.