Key Insights

- US President Donald Trump has just signed an executive order to create a national crypto (especially bitcoin) stockpile.

- This is great news for the crypto industry and shows a great deal of mainstream acceptance.

- However, the market crashed instead of rallying after White House David Sacks weighed in.

- According to Sacks, this reserve will contain only crypto seized from criminal forfeitures and other means.

- Other assets to be included are Ethereum, Solana, XRP, and Cardano.

US president Donald Trump has just signed an executive order, just as he promised during the presidential elections in November of last year.

The president has now ordered the creation of a national strategic Bitcoin reserve.

In essence, the US is now one of the first countries to have a national crypto stockpile.

This decision shows a major shift in the US government’s approach to digital assets and could have even deeper roles to play in how crypto is treated within and outside the US.

Here’s everything to keep in mind.

A Digital Fort Knox

As hinted by Donald Trump himself in an earlier Truth Social post, the newly established reserve will consist of Bitcoin and other cryptocurrencies.

Most of the crypto to be added to this stockpile will be from federal government seizure, whether through civil or criminal asset forfeiture cases.

According to David Sacks in a lengthy X post, the White House crypto czar, the US will not be selling any crypto deposited into the reserve and will instead hold it as a store of value.

Comparatively to a “digital Fort Knox.”

In addition, a separate “U.S. Digital Asset Stockpile” will be created. This separate stockpile will contain cryptocurrencies aside from Bitcoin, even though the US government does not plan to buy more than what it gets through these criminal seizures.

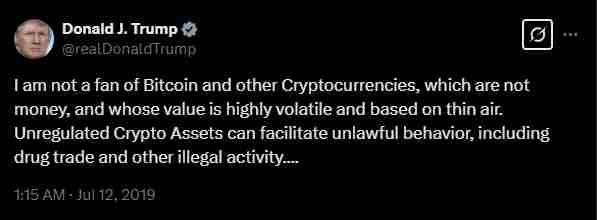

Trump’s Crypto Pivot

This move from Donald Trump shows a major shift in his stance on crypto over the years.

Back in 2019, Trump took to Twitter to dismiss Bitcoin as a “scam,” whose value was “based on thin air.”

The US president now actively supports the industry six years later and has also stated his ambition to make the U.S. the “Crypto Capital of the World.

His move also contrasts sharply with the approach of Joe Biden, his predecessor, to the issue of crypto.

The Biden/Harris administration took a much harsher regulatory approach to crypto, with former SEC Chair Gary Gensler at the helm of the agency.

Donald Trump’s pro-crypto policies have gained him strong backing from the industry.

Many crypto industry leaders played major roles in his re-election campaign, and the Trump family itself has launched everything from memecoins to the World Liberty Financial platform so far.

How Will the Strategic Reserve Work?

Despite the hype and the fanfare, there are still scarce details about the reserve and what it entails.

There are currently no specifics about how the US government plans to manage its holdings.

Taxpayers have no idea how this initiative benefits them either.

On the other hand, Sacks mentioned that the government would develop “budget-neutral strategies” for buying more Bitcoin without having to spend taxpayer dollars.

However, despite this reassurance, details still remain scarce.

So far, Sacks has estimated that the US government holds around 200,000 Bitcoin, valued at around $17.5 billion.

According to him, the premature sales of some of this forfeited Bitcoin have cost taxpayers billions in what would have been possible income if the assets had remained unsold.

However, there has still been no way to verify these estimates.

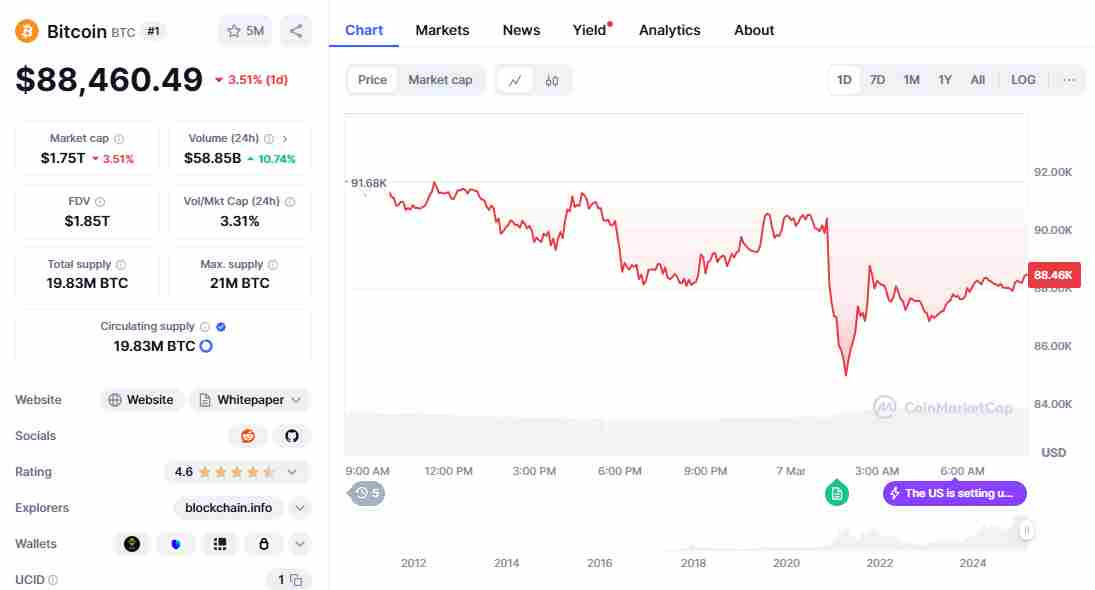

How Did The Crypto Market React?

The announcement of the US’ strategic reserve initially caused a price spike for bitcoin earlier in the year.

The move caused a price spike for the cryptocurrency to a new high of $109,071.86 in January.

However, as soon as Sacks clarified that the U.S. government would not actively purchase Bitcoin this week, the price of the cryptocurrency has crashed by over 5% below $85,000.

So far, Bitcoin has stabilized around the $88,109 zone at the time of writing and is hovering right underneath the psychological $90,000 zone.

Crypto investors have been divided over the news. Many have seen these reserves as a sign of institutional influence on Bitcoin’s part.

On the other hand, commentators like Capriole Investments founder Charles Edwards have criticized the move from the US government as an “empty gesture.”

Edwards believes that the reserve merely formalizes holdings the government already had.

Legal and Political Hurdles Ahead

There are still some uncertainties to iron out as Donald Trump establishes the reserve.

It is currently unclear whether such a move will require approval from Congress or whether any regulatory challenges remain ahead.

There is always a risk that lawmakers and certain financial watchdogs may push back against the idea.

These agencies and individuals will likely question the necessity of holding crypto as a national asset.

There is also the issue of skepticism when it comes to prioritizing crypto over other economic issues.

The US currently has broader issues pertaining to inflation and national debt, which could lead to heated debates in the future.

Critics have so far argued that the pro-crypto policy merely benefits wealthy crypto investors rather than the general public.

Strategic Reserves in Global Finance

It is worth mentioning that strategic reserves as a concept are not new.

Governments around the world hold reserves in several assets, with the US itself having a “Strategic Petroleum Reserve.”

This reserve helps to stabilize the energy markets and has worked out well so far.

Canada also has a “maple syrup reserve”, which performs the same function in a different market.

However, the major concern with Bitcoin as a reserve asset will likely come from its extreme volatility and how suitable it is for such a role.

If Bitcoin continues to grow in value, the reserve could follow suit though and provide many long-term rewards to the U.S. government.

In addition to Bitcoin, Donald Trump intends to feature other cryptocurrencies in the reserve, including Ethereum, XRP, Solana, and Cardano.

Overall, Donald Trump’s executive order marks a major shift for crypto adoption in the US.

But will the reserve lead to greater stability in the crypto market, or is it merely a political move to garner industry support?