Key Insights

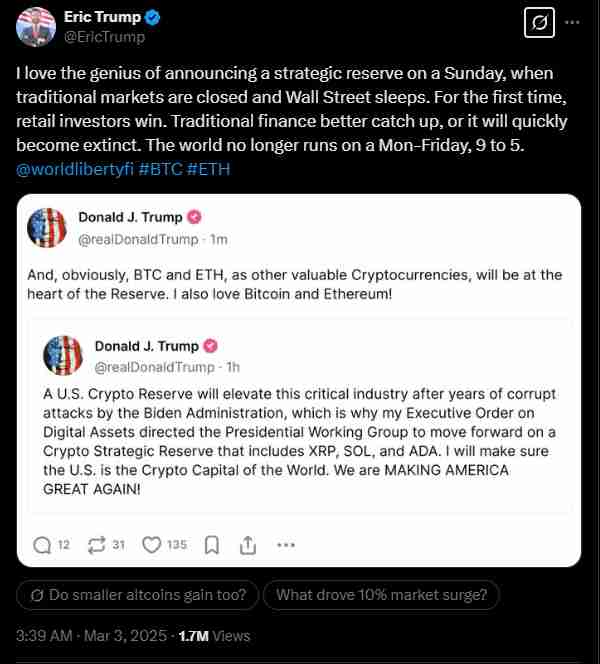

- The US president, Donald Trump, recently announced the launch of a new strategic crypto reserve.

- This reserve will contain not only Bitcoin but also Ethereum, Solana, XRP, and Cardano.

- All of these cryptos were specifically chosen for their roles in defi and for their specific strengths.

- The move marks a major shift in how crypto is perceived and could have wider implications for investors, the US economy, and the rest of the world.

- The crypto market is up by double digits today, with mainstream cryptos turning green.

The crypto landscape has shifted strongly today, especially with the announcement of a US strategic crypto reserve by President Donald Trump.

This decision could completely change the country’s financial system and is likely to have strong implications for the rest of the world.

The unexpected shift in the US’ policy towards digital assets also signals a new era for this evolving space, with the US as a possible leader in blockchain technology.

Here’s what this means for crypto and for you as an investor.

A Leap into the Digital Future

For years, the US government has been cautious about crypto. The country’s securities and exchange commission (SEC) was especially harsh on the sector during the Biden/Harris administration, with Gary Gensler as the agency’s chair.

However, the recent decision by Donald Trump to establish a reserve in the country shows that things have changed strongly.

The US is now set to integrate several major cryptocurrencies, including Bitcoin, Ethereum, XRP, Solana, and Cardano, into the country’s infrastructure.

In essence, crypto is here to stay.

Why These Five Cryptocurrencies?

The question now is, “why these cryptocurrencies, and not others?”

The US’ selection of Bitcoin, Ethereum, XRP, Solana, and Cardano for the strategic reserve was a deliberate move, considering how each asset offers unique advantages.

For example, Bitcoin, which is often referred to as “digital gold,” is the most recognized and widely accepted digital asset.

Ethereum, on the other hand, is the backbone of defi and smart contracts. It is by far the largest smart contract-enabled platform, according to data from DefiLlama.

XRP is the leader in terms of fast and cheap cross-border transactions and is widely used among many financial institutions.

Solana is one of the fastest mainstream blockchains and is a direct competitor to Ethereum.

Finally, Cardano has a research-driven approach to blockchain technology. It is also highly focused on scalability, which is highly important in the space.

Donald Trump’s endorsement of these cryptocurrencies as part of the US financial framework shows that the US government aims to be committed to blockchain technology for the long term.

Crypto Prices Surge

This event expectedly caused price explosions across the crypto market as many traders rushed to scoop up their favorite assets.

The announcement triggered a massive rally on Bitcoin, with a 9% price surge over the last 24 hours, to a new high of around $93,000.

Ethereum saw an 11% climb towards $2,500, and XRP shot up by a staggering 30% to $2.80.

Solana and Cardano overshadowed every single one of the aforementioned, with ADA jumping nearly 60% above $1.

The price surge shows that investor confidence is returning in crypto, especially as the US government now officially recognizes it as a legitimate asset class.

Put simply, this new development could be a major defining moment for the market as a whole.

How Does This Affect You as an Investor?

The recent national reserve announcement offers the cryptocurrency market both opportunities and problems.

On one hand, the US government’s endorsement of digital assets could drive mass adoption and make them more widely accepted as a means of payment.

This could mean that more businesses will accept them as payments, and customers will feel more comfortable spending.

Investors have much to gain as well, especially those holding Bitcoin, Ethereum, XRP, Solana, or Cardano.

These cryptocurrencies are poised to rally even further higher, in a profit-making spree for many.

On the other hand, crypto entering the spotlight could warrant tighter regulations.

While regulations can be great for investor security, they have also been known to stifle innovation on many occasions.

The crypto market “might” see restrictions of some kind on activities like trading, taxation, spending, and other aspects.

A Shift in Global Finance

More than mere individual investment, this move is expected to have more serious implications for the US economy.

For example, the national reserve announcement puts the US as a forward-thinking country when it comes to innovation.

Keep in mind that countries like El Salvador have already made bigger moves by embracing Bitcoin as legal tender.

However, a move of this scale from the world’s largest economy is bound to have even stronger implications.

Another huge impact this could have is on the U.S. dollar’s role as the “major” global reserve currency.

The country embracing crypto (rather than resisting it) could help the US dollar to maintain its role as a leader among currencies.

There Are Still Many Unanswered Questions

The recent announcement is a highly impressive one for the crypto space. However, many questions still remain unanswered.

For example, the announcement fails to mention how the reserve will be managed.

Will the government actively trade these assets, or simply hold them as long-term assets?

Will more cryptos be added in the future? What will be the country’s approach to selling if the need arises?

Amid the announcement hype, these questions are pressing ones and demand answers over the next few months.

Overall, Trump’s announcement marks a major turning point for this space.

The sector is moving from being a mere asset class on the corner of the financial market to being part of a whole country’s economic strategy.

Crypto is becoming more and more acknowledged by the day, and the future of this initiative remains to be seen.