Key Insights

- The crypto market recovered strongly after a major crash over the last week.

- Soon after this recovery, the markets crashed again, erasing most of its gains.

- The reason for this crash was likely the new announcements from Donald Trump about an increase in tariffs on imports from China, Mexico, and Canada.

- This announcement sparked a broader sell-off across the crypto and stock markets.

- The crypto market lost around $500 billion of its market cap, with $1 billion in liquidations.

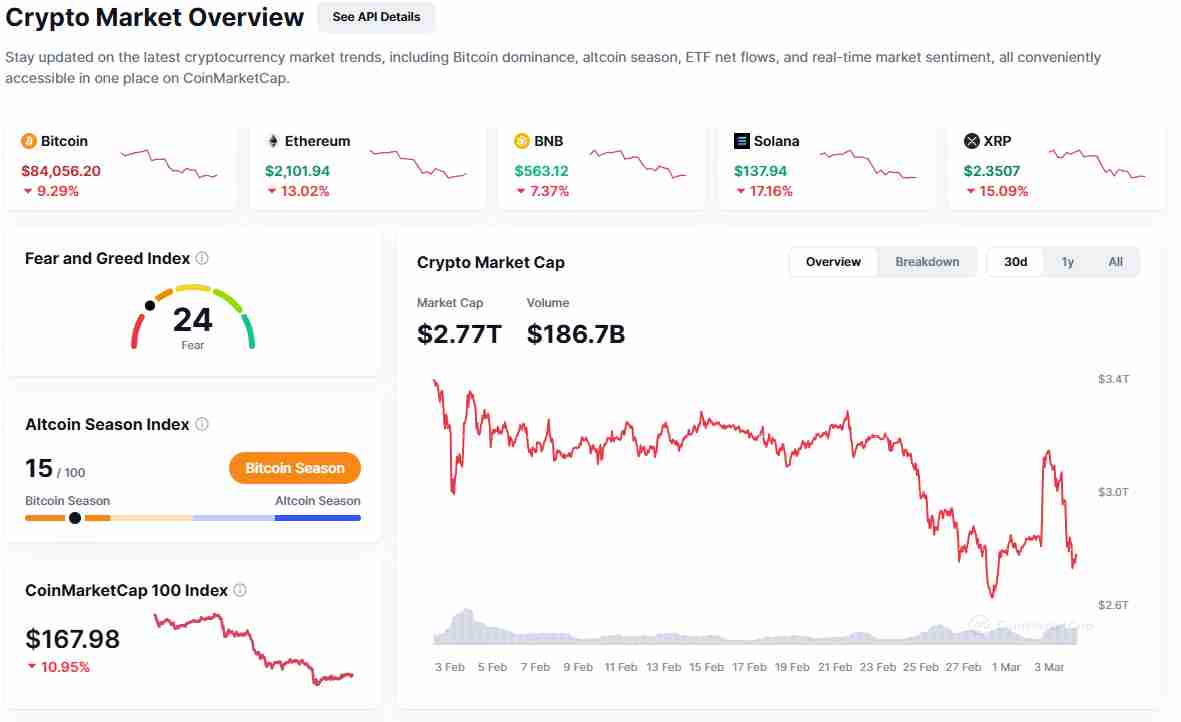

The crypto market is in the middle of another crash, especially with major cryptos like Bitcoin, Ethereum, and XRP taking serious hits.

Bitcoin has dropped by around 10% over the last 24 hours, with Ethereum falling by 15% within the same timeframe.

This decline spread towards the altcoin market as well, with XRP plunging by 17% and Cardano taking a staggering 21% step backwards.

What caused this sell-off, and what could be next for the crypto market?

Bitcoin’s Price Drop and CME Gaps

The recent price dump might be partly due to the CME gaps.

For context, CME gaps are price gaps on the Chicago Mercantile Exchange that Bitcoin tends to fill before making a major move.

According to insights from Coinvo, Bitcoin recently filled the gap around $85,000.

Rekt Capital further emphasized that the cryptocurrency has successfully filled all of its gaps within a single week, between $78000 and $80700 as well as $92800 and $94000.

However, a new one sits at around $84650 and ~$93300, and the pain might not be over yet.

These gaps can be thought of as price magnets, pulling the price of Bitcoin down before a valid leg up.

Analysts in general expect a possible continuation of the dip before a rebound occurs.

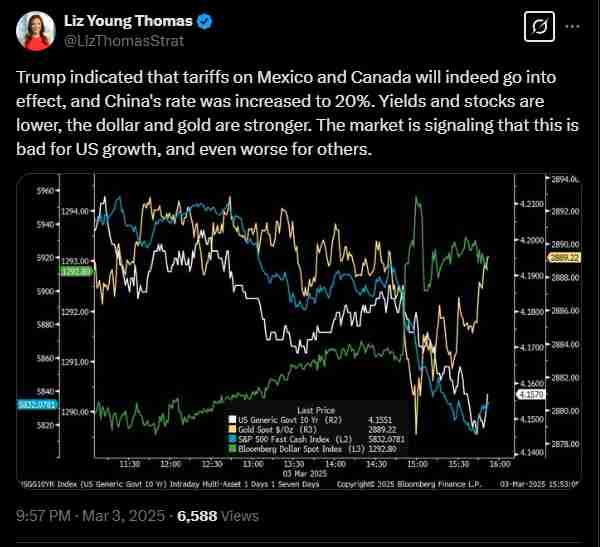

In addition to the ongoing chaos, the stock market is also experiencing turbulence.

Between 10:00 AM and 3:30 PM ET, the S&P 500 erased a staggering $1.5 trillion in market cap.

Interestingly, this sell-off came right after Taiwanese semiconductor giant TSMC revealed a $100 billion investment in the U.S.

However, this optimism soon died after concerns about tariffs and economic instability came to light again.

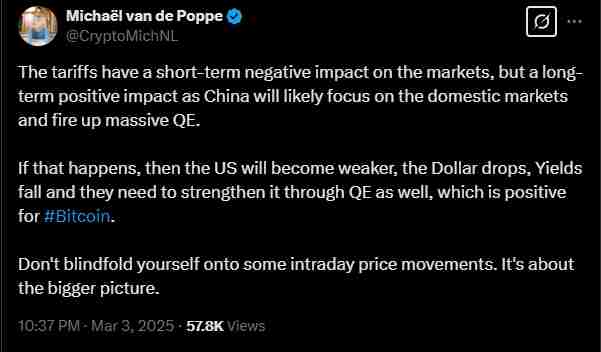

The Tariff Issues Come Out To Play

One major factor behind the crypto market’s decline was Donald Trump taking to Truth Social once again to confirm that the tariffs on Canada and Mexico will take effect on March 4 as planned.

This came amid market hopes for another delay, as the US is now preparing to include a 25% levy on goods from both countries.

Further complicating matters, the White House also confirmed an executive order from Trump, increasing tariffs on Chinese imports to 20%.

This marks a massive increase in tariff rates in just two months and adds more fuel to the possible trade war between these countries.

The U.S. average tariff rate is now approaching dangerously high levels, not seen since the Great Depression, according to The Kobeissi Letter.

There are also growing concerns about a possible 100% tariff against BRICS countries, which could add more instability to the mix.

$1 Billion Wiped Off the Crypto Market

The crash in prices affected the most of the crypto market, with the entire sector losing $500 billion in market cap.

The total crypto market cap now sits at around $2.77 trillion after crashing underneath the $3 trillion mark in the late-February downturn.

This downturn came just as investors were enjoying the euphoria of Trump’s U.S. Crypto Reserve announcement.

The reserve, which was expected to focus only on Bitcoin, took many investors by surprise when it was revealed to include altcoins like Ethereum, Solana, Cardano, and XRP.

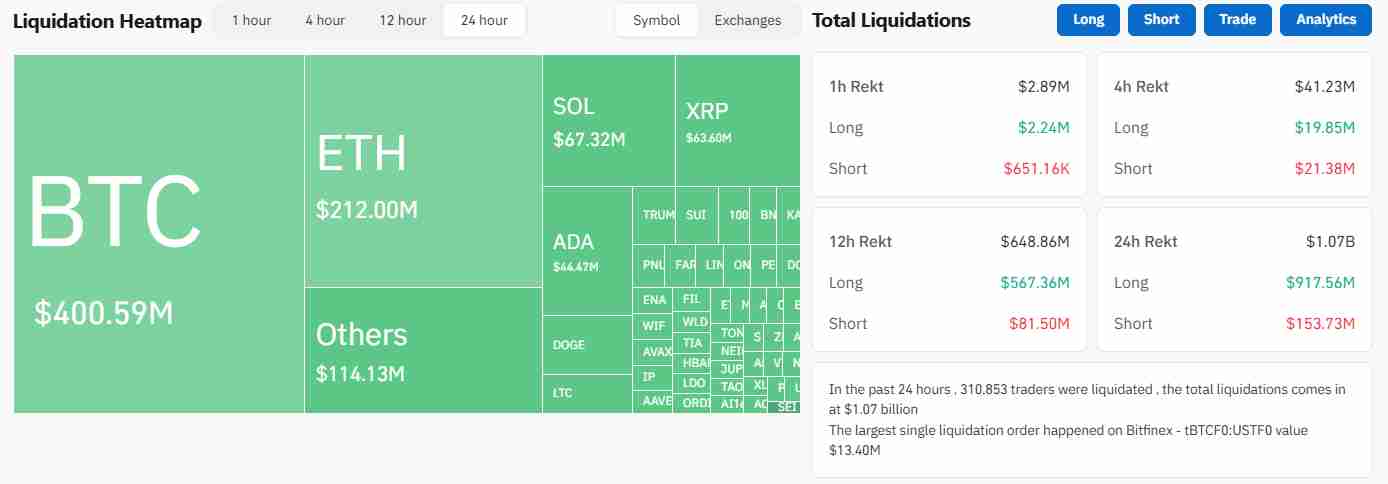

The ongoing crypto market decline has wiped out $1 billion in terms of liquidations across the board.

Ethereum suffered the most after losing all its gains from the earlier pump.

The cryptocurrency now trades at a current price of around $2,101, which is dangerously close to a break below the $2,000 zone.

Other major altcoins also experienced between 17% to 25% declines within the same timeframe, mirroring Bitcoin’s behavior.

Investors will continue to monitor upcoming developments in the crypto and stock markets.

David Sacks, the White House’s AI and Crypto Czar, recently hinted at further announcements during the first-ever White House Crypto Summit, which is set to happen this week.

If new details about the Federal Reserve emerge, it could possibly trigger a recovery.

What’s Next for Crypto?

The recent crash has spooked investors across the crypto and stock markets.

However, historically speaking, Bitcoin tends to recover hard after filling CME gaps.

The crypto market is no stranger to volatility, and many traders see the current dip as a buying opportunity.

Some major events to watch include the upcoming White House Crypto Summit and any other new developments with the tariff plans.

Traders are on the lookout for signs that the US’ and the rest of the world’s economy is stabilizing, especially as the crypto and stock market now seem to depend strongly on this sector.

In the short term, the market is still highly volatile and should be approached with caution.

Over the long term, however, investors can rest assured that better days are coming for Bitcoin, the rest of the altcoin market, and the stock market.