Key Takeaways

- Dogecoin (DOGE) is currently in the middle of a broader market decline and is testing key support.

- This decline has affected most of the memecoin market, with many assets being 50% down from local highs at least.

- The cryptocurrency needs to hold support around $0.17 to register another pump towards $1.

- A break below this support could lead to a decline towards $0.08 or lower.

- Despite broader bearish sentiment, the long-term outlook for Dogecoin is bullish, with a multi-year trend.

Dogecoin has been struggling over the last few months and has come a long way from its $0.48 local high.

As it stands, DOGE is now bracing for a rare “death cross” pattern, and investors are wondering:

Has the worst of the downturn come, or is more pain ahead?

Let’s breakdown what’s been going on with DOGE—its current technical outlook and what the future might hold for the memecoin king.

Dogecoin’s Price Drop—What’s Happening?

DOGE recently fell to $0.19, which was its lowest level since November of last year.

As if this wasn’t enough, the memecoin trekked further downwards to the $0.165 zone during the weekend, as the rest of the altcoin market crashed alongside.

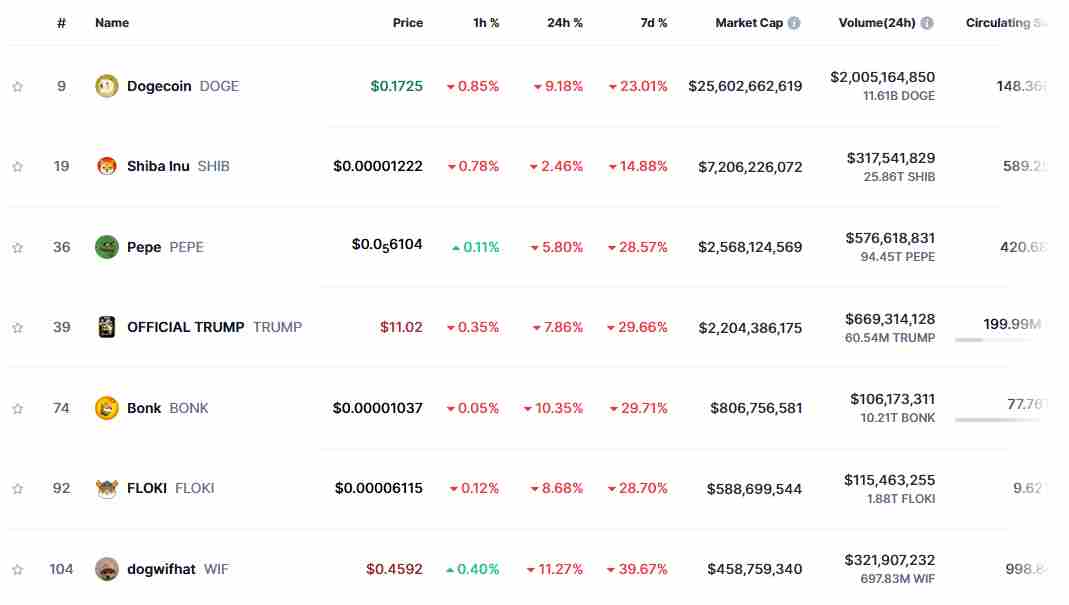

CoinMarketCap data shows that DOGE is down by around 10% over the last 24 hours by press time and by around 23% over the last week.

This is alongside the loss of around 60% of its value since its peak in November.

The decline also mirrors a wider decline among other memecoins, with SHIB, PEPE, WIF, BONK, and others plunging by more than 50% over the last few months.

One of the key reasons behind this decline in DOGE and the rest of the memecoin market is the general crypto decline from Bitcoin and Ethereum.

Bitcoin has been down by more than 10% over the last week, despite bullish indicators between 5 and 7 March.

Another key reason for this decline in DOGE, especially, could be tied to its biggest influencer—Elon Musk.

Recent data shows that the US stock market is crashing, leading to a tough financial year for Musk and other billionaire entrepreneurs.

Musk is also facing growing political pressure with the newly-created DOGE (Department of Government Efficiency), which means that Elon Musk, Dogecoin, and the DOGE department are all under some serious fire.

The Technical Picture—Death Cross and Fibonacci Levels

This isn’t the worst of it for Dogecoin. According to the daily charts, a disturbing technical pattern has emerged between the 50 and 200-day SMAs.

As it stands, these two moving averages are on the verge of forming a “death cross.”

For some context, a death cross occurs when the 50-day moving average crosses below the 200-day moving average.

It can be a major indicator of bearishness and would be very disturbing indeed, if confirmed.

Keep in mind that the opposite of this pattern is called a “golden cross” and occurred once on 5 November.

This golden cross eventually led to the rally that took Dogecoin up from $0.14 to as high as $0.48 in a 254% rally.

It is also interesting how the last death cross on Dogecoin in July of last year caused a 40% decline from shortly afterward.

With this in mind, golden crosses have proven to be highly accurate at predicting Dogecoin’s price performance.

If one occurs now, Dogecoin could lose the $0.167 support and crash lower.

Further technical indicators also show that more pain could be ahead for Dogecoin if the bulls fail to step up, especially with the MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) both showing severe bearish strength compared to the bulls.

Dogecoin is currently struggling to hold this $0.167 support. But if the bears win, the worst-case scenario could be $0.08—a staggering 70% drop from current levels.

Is a 1,450% Rally Still Possible?

Despite the mounting bearish signals, many analysts are still optimistic about Dogecoin’s chances.

Independent crypto analyst Ali Martinez recently shared an update on X, which showed that Dogecoin could be ready for a major rebound if it holds a critical support level.

Martinez pointed out an ascending channel pattern on the Dogecoin weekly chart.

The interesting part about this pattern is that it has held since 2015. Historically, the memecoin had always rebounded after hitting the lower boundary of this channel.

This means that if the pattern holds true, the memecoin could be in for a sharp recovery.

In an earlier tweet, the analyst also mentioned, “If Dogecoin maintains support at the channel’s lower boundary at $0.17, it could trigger a strong rebound toward $2.74!”

Key Levels to Watch

At the time of writing, Dogecoin currently trades around the

At present, Dogecoin’s price is hovering around $0.173, which is a crucial support level.

From the above analyses, if Dogecoin holds above the $0.17 price level, it could start (and sustain) an uptrend that helps it to break higher resistance levels.

A drop below $0.17, on the other hand, will inevitably lead to more losses.

It would invalidate the entire bullish structure and lead to a retest of the $0.08 – $0.06 zone.

A full rebound off this support could lead to a strong rally towards $1, or even the $2.74 zone, as Ali says.

The Bottom Line

Dogecoin trades at around $0.17 at the time of writing and is down by nearly 12% in the last 24 hours.

Its trading volume is on the rise, however, increasing by 11.44% to $1.36 billion.

In the future, Dogecoin’s trajectory will depend on how well it can hold its key support levels and break through resistance zones.

If the cryptocurrency remains above the $0.17 zone, we could see a strong recovery and even a retest of the $1 zone.

However, a break below could lead to a sharp decline and force traders to reconsider their positions.