5 Ways to Earn Passive Income from Crypto Lending

Key Insights

- Lending in crypto can be a great way to make passive income.

- Some of the best ways include P2P, Cefi, Defi, stablecoin, and staking + lending.

- The riskiest and most profitable of these include P2P and the staking + lending approach.

- Cefi, Defi, and stablecoin lending have varying levels of risk that are proportional to their reward levels.

Gone are the days when making money off the crypto market was only about trading.

Nowadays, the popularity of smart contracts and Dapps has opened up new avenues to earn profits from the market:

And an interesting one is from crypto lending.

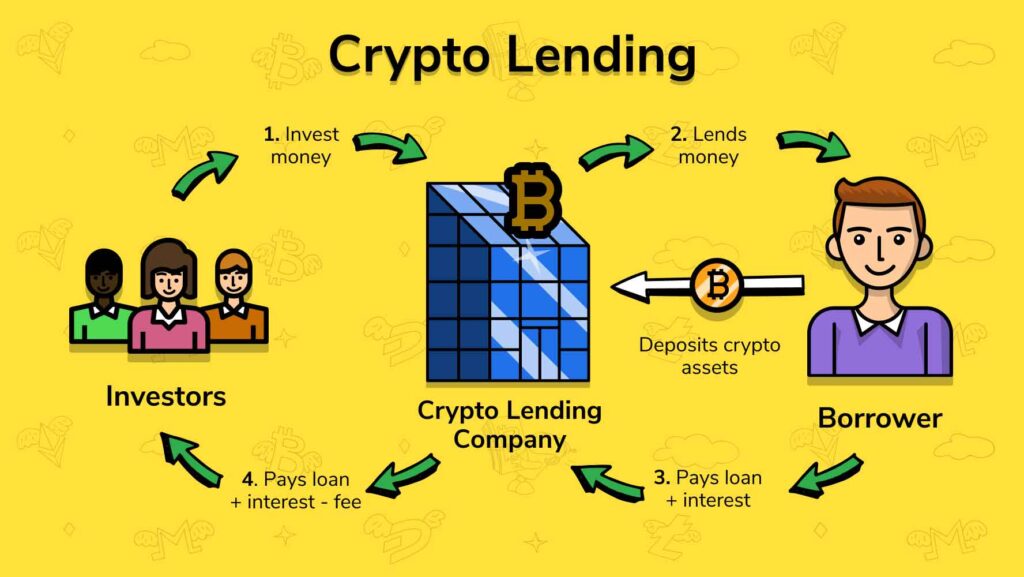

Lending in the world of crypto is precisely what it sounds like. You simply lend your crypto to borrowers in exchange for interest.

This offers a straightforward way to make crypto work for you, and here are five of the biggest ways to get started.

Each of them with their benefits and risk levels, of course.

1. Earn Interest Through Centralized Lending Platforms

This method is one of the most straightforward by far. Certain centralized platforms like Celsius, Nexo and BlockFi allow users to deposit their assets and simply earn interest.

This is very similar to how people take their fiat to banks in exchange for a set amount of interest over a given period.

Once you deposit your crypto into these centralized platforms, the algorithms that run them simply lend it to other users (or borrowers).

The borrowers pay interest upon returning the loan, which is transferred to the lenders.

These platforms offer set interest rates (depending on the cryptocurrency) and can be pretty convenient to use.

The approach is mainly recommended for beginners who aren’t used to much complexity.

Keep in mind, though, that transacting with a centralized platform involves trusting them with your funds.

Pros

- User-friendly

- Constant interest rates

- Wider range of assets

Cons

- Platforms hold your assets, not you.

- In case of hacks or bankruptcy, your funds are at risk.

2. DeFi Lending

This is the direct opposite of centralized lending.

Certain Defi lending platforms, such as Aave, Compound, and MakerDAO, allow users to lend their assets directly to borrowers without needing to go through a third party.

These platforms use smart contracts to automate the entire thing and often provide higher returns to lenders than the former.

You deposit your crypto into a lending pool, where borrowers can access it, and you start earning interest immediately.

The major downside, though, is that interest rates on defi platforms can fluctuate wildly, depending on factors like market demand and volatility.

Defi lending is easy enough but requires at least a basic understanding of blockchain technology.

Users also need to understand things like crypto wallets, private keys, crypto security, and so on.

The major risk in this approach is that, in the case of smart contract bugs, a hacker could gain access to the lending pools and steal funds.

Interest rates could also spike unreasonably and cause problems for both lenders and borrowers.

Despite the safety issues, these platforms are still a powerful way to make money off crypto lending.

Pros

- There is no need for intermediaries.

- They often come with higher interest rates (meaning more profit for lenders)

- Transactions are completely anonymous.

Cons

- This approach requires technical knowledge.

- Smart contract vulnerability is still a major issue.

3. Earn Dual Income with Crypto Staking and Lending

For the unaware, crypto staking lets users earn rewards by simply “locking” their assets within a Proof of Stake network—like Ethereum or Polygon.

Some platforms, however, take this a step further,

Users can now lend out their staked assets—they can then make profits, not only from the staking rewards but from lending as well.

This dual-income approach is a major way to make even higher profits.

The major risk, though, is that the risk is generally higher as there are multiple points of failure.

Users who decide to take the dual approach must accept the conditions of the staking platform and the lending protocol.

Pros

- It’s a great way to make both staking and lending income.

- Has better returns.

- No need for active staking.

Cons

- If the staking or protocol fails, assets are lost.

- This double-stepped approach opens the door to more points of failure.

- Requires extensive research.

- Above Defi knowledge is required.

4. Earn Passive Income with Stablecoin Lending

Instead of lending using regular crypto, users can opt for stablecoin lending.

Stablecoins are a lot less volatile than normal cryptocurrencies.

This means that they are perfect for investors who are more on the risk-averse side.

Anyone can lend out coins like USDC, USDT or DAI and earn interest—all while avoiding the ups and downs of the crypto market.

Several platforms offer stablecoin staking services, including Binance, Crypto.com, and even some Defi services.

Keep in mind that while stablecoin lending is a relatively very safe option, the chosen platform still needs to be as secure as possible.

Pros

- Offers stable returns due to lower volatility.

- Provide higher interest rates compared to lending fiat.

- Offered by many platforms.

Cons

- The platform on which assets are staked could fail.

- The stablecoin issuer itself could get hacked.

- Generally lower returns compared to regular lending

5. Peer-to-Peer (P2P) Lending

P2P lending allows customers to lend crypto directly to other individuals through a P2P platform.

Some great examples of these include Hodlnaut or Bitfinex, where users can even set their own terms for interest rates.

Users can also decide on things like loan duration, giving them much more control over how and when assets are lent.

One of the great advantages of P2P lending is that users get higher returns and can negotiate personal terms with borrowers.

However, as expected, this approach is likely the riskiest of all.

Pros

- Allows greater control over lending terms.

- Higher returns.

- Lenders can choose borrowers and collateral levels.

Cons

- Requires a lot of research.

- Borrowers could default on loans.

- Requires extensive defi knowledge.

Crypto lending is a great way to make income in the crypto market.

However, it is important to choose the approach that best suits one’s skill level, risk tolerance, and expected profit.

In conclusion, crypto lending offers a unique and accessible way to generate passive income, allowing you to earn returns by lending your assets in a secure and flexible environment.

By exploring options such as interest-earning accounts, staking, DeFi lending, liquidity pools, and lending platforms, you can diversify your income streams and make your crypto work for you.

Remember to research and understand the risks involved in each method to make informed decisions. With the right approach, crypto lending can become a powerful tool in building long-term financial growth and stability.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)