From Rug Pull to Millions—How Crypto Community Rescued a Dumped Token?

Key Insights

- A young trader created and launched a token called $QUANT this week before turning it into a massive rug pull on Livestream.

- The crypto community pushed $QUANT further by another 900% after the rug pull.

- Even though the trader made $30,000 from the scheme but would have, he would have made $4 million if he’d held on

- The $QUANT saga shows how collective investor sentiment can turn even a doomed project into a massive success story.

The crypto market is full of rug pulls and scams, which are more common in times like these when the price of Bitcoin and several new cryptocurrencies are making new highs.

However, amid the hacks and scams, the market is also full of surprises—and hope.

One recent story from last week shows how a rug-pulled token turned out to be a multi-million-dollar opportunity for several investors.

Here’s how a kid created a token and rug-pulled it on livestream—plus everything that happened after.

The Collapse of $QUANT

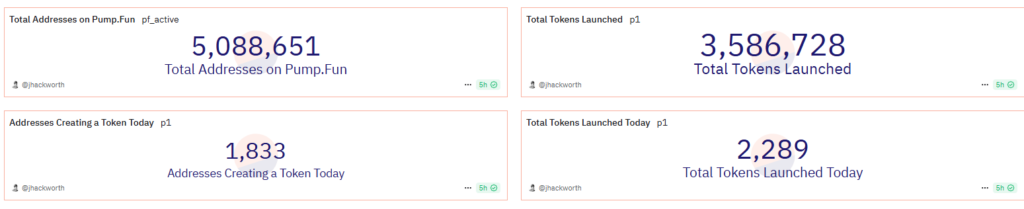

Pump.fun is one of the most popular Dapps built on the Solana network.

It allows anyone to create Solana-based tokens with only a few clicks of a button while spending only a few cents.

Data from Dune Analytics shows that the platform has been responsible for more than 3 million new tokens over the last year—most of which (expectedly) turned out to be scams.

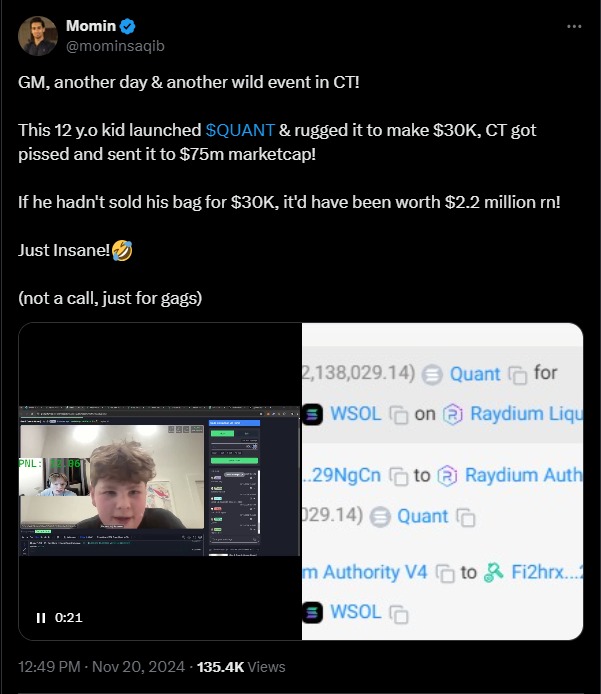

This week, a young trader used the tool to create and launch a new token on livestream.

He called this token Gen Z Quant ($QUANT).

Soon after the token’s price began to climb, the trader in question abruptly sold off all 51 million of his tokens for 128 SOL (worth $29,600 at the time) in an obvious rug pull.

This move should have led to the token’s collapse; however, the “degen” community had other plans.

Instead of letting $QUANT die and fade into obscurity, investors rallied around and started to pump liquidity into the project.

Before long, the token’s price had climbed by over 900% within mere hours.

Interestingly, if the young trader had held on to their tokens, their $29,600 would have skyrocketed to a staggering $4 million.

The Aftermath of $QUANT

The unexpected support from the community didn’t just stabilize $QUANT.

Everything that happened after became a massive success story.

At its peak, the token’s market cap grew to around $80 million, a perfect example of how powerful collective investor sentiment can be in the crypto space.

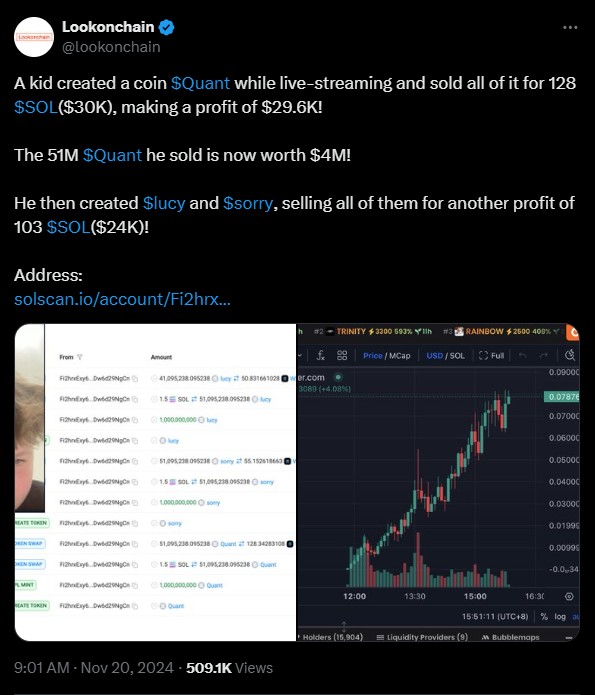

Interestingly, despite what happened with $QUANT, the original creator went on to launch two new tokens called LUCY and SORRY.

Unsurprisingly, they repeated the rug pull tactic and made an additional $24,000.

More Millionaires From Memecoins

More millionaires emerged from this story. While some traders face massive losses from rug-pull stories like these, others strike gold,

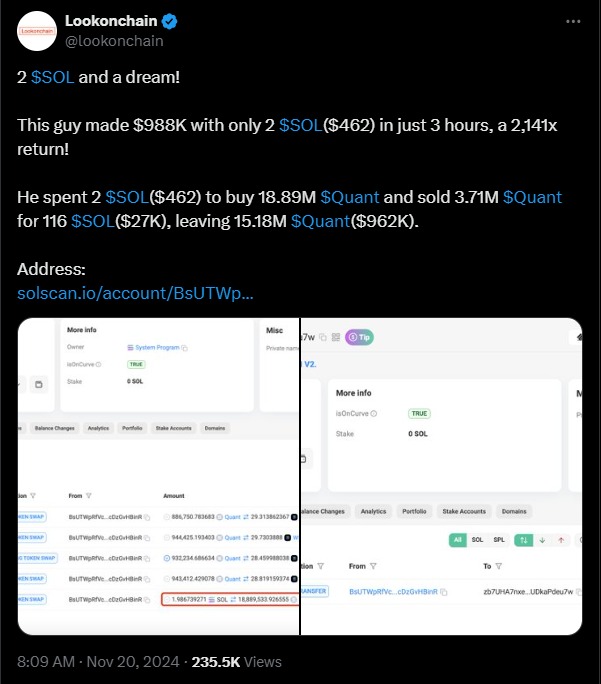

Some of the notable examples include a trader nicknamed “sundayfunday.sol”.

According to LookOnChain, Sunday Funday managed to turn a $72,000 investment into a jaw-dropping $30 million within three days by trading $QUANT.

Another trader made nearly $1 million in just three hours by investing only 2 SOL (worth $460 at the time) in $QUANT.

These stories show the volatile nature of memecoins as well as how traders either make a fortune or lose it all in a matter of hours.

Rug Pulls and Risky Business

While stories of millionaire traders dominate the headlines, other traders lose millions.

Memecoins thrive on speculation and sometimes come with heavy volatility that breaks traders in hours.

Investors must remember that for every success story, countless others end in losses.

The $QUANT saga shows the importance of caution in crypto trading

While the community often flips the script with its resilience, blind investment often results in ruin for investors.

As a result, it is important to understand the risks and always stay informed.

Despite their issues, memecoins are perfect opportunities for traders looking for high-risk, high-reward opportunities.

The story of $QUANT serves as a major reminder of the unpredictability of the crypto (and memecoin) market.

![Top Altcoins in October [2024] You Should Look Out For 23 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)