How Trump’s Win Made Elon Musk $70 Billion Richer?

Key Insights

- After Donald Trump’s win in the U.S. presidential election, the wealth of world billionaires has exploded.

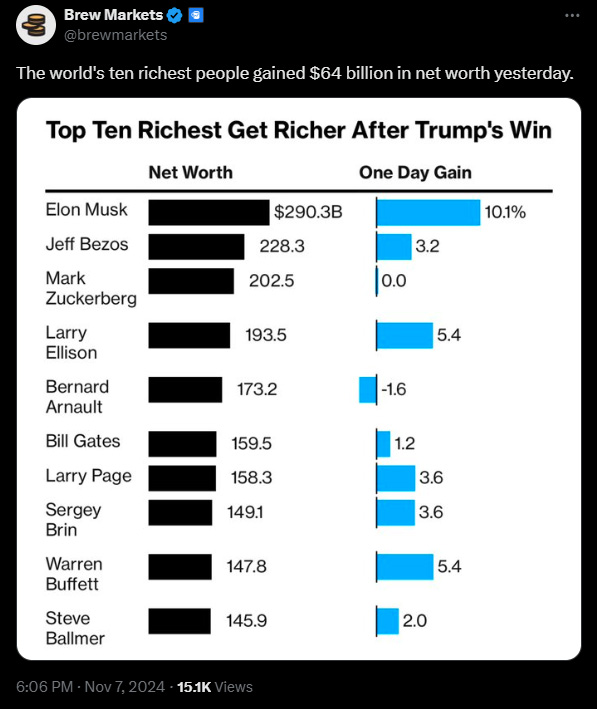

- Individuals like Elon Musk, Mark Zuckerberg, and Jeff Bezos have increased their net worth by an impressive $64 billion.

- Meanwhile, there are now calls for a reform or a complete dissolution of the U.S. Federal Reserve.

- The incoming Trump administration is expected to have massive consequences for the financial markets, in and out of the U.S.

Over a week after Donald Trump won the U.S. presidential election, ripples are still echoing in the worldwide financial markets.

In particular, the world’s wealthiest individuals like Elon Musk and Jeff Bezos saw massive gains.

The fortunes of these individuals surged by a collective $64 billion, led by Elon Musk’s eye-popping $26.5 billion.

This boom in wealth shows the impact of politics on most financial markets.

It has also sparked fresh debates around issues like economic reform and calls to abolish the U.S. Federal Reserve.

Let’s see what’s been up.

US Election 2024: Wealthiest Individuals Reap Massive Gains

Right after Trump’s win in the U.S., the country’s stock market saw a powerful rally as investors expected a low-tax, deregulation-focused agenda.

This optimism translated into massive gains for the wealthiest individuals, according to details from the Bloomberg Billionaires Index .

Some of the notable beneficiaries included:

- Elon Musk’s fortune increased by $26.5 billion in a single day, bringing his net worth to a staggering $290 billion.

- Musk, who was also a huge Trump supporter, benefited from the surge in Tesla’s stock price, in which he holds a huge stake.

- Jeff Bezos, the founder of Amazon, was already the world’s second-richest person. Bezos added an impressive $7 billion to his fortune, bringing his net worth close to $230 billion.

- Larry Ellison, the chairman of Oracle (who is known as a big Trump supporter), saw his wealth rise by nearly $10 billion to reach $193 billion.

Source: Twitter

Other tech billionaires, such as Meta’s Mark Zuckerberg, Microsoft’s Bill Gates, and Google’s Sergey Brin/Larry Page, also saw massive wealth increases from the stock surge.

Analysts generally believe this rise in stock prices came from Trump’s clear win and the favorable business policies his administration is expected to implement.

The Growing Sentiment Against the Federal Reserve

In the wake of Trump’s victory, a growing movement is now calling for the Federal Reserve to be dissolved.

Think of the U.S. Federal Reserve as the central bank of the United States.

It is responsible for monetary policies like interest rate cuts or hikes and is chaired by Jerome Powell.

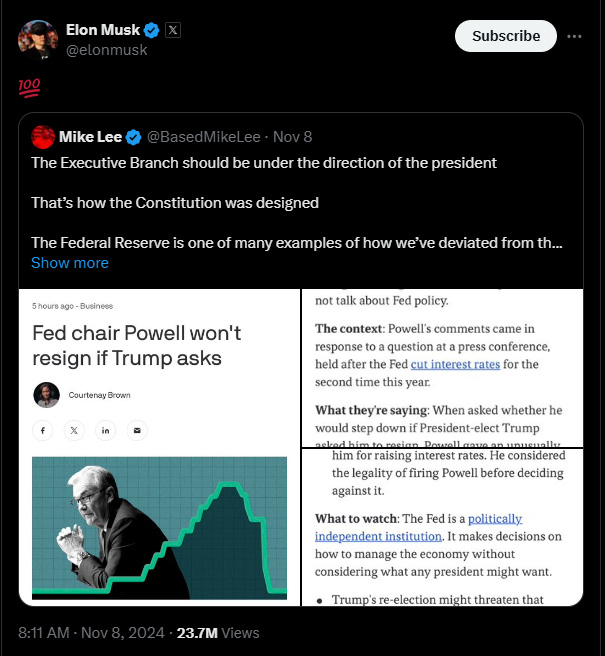

According to recent reports, Elon Musk appears to have joined the movement after reposting a tweet from Utah Senator Mike Lee.

In the tweet, Lee voiced his concerns about the Federal Reserve’s independence and Jerome Powell’s refusal to step down.

Lee believes that the Federal Reserve has shifted significantly from its constitutional mandate.

According to Lee, the Federal Reserve’s lack of executive oversight shows a “deviation” from the principles laid out in the U.S. Constitution.

This sentiment is further echoed by Bitcoin supporters who believe that centrally managed fiat leads to inflation/devaluation.

Bitcoin’s Growing Role as a Hedge Against Inflation

As calls to abolish the Federal Reserve continue to grow, Bitcoin’s reputation as a hedge against inflation is gaining traction.

This explains the current skyrocket in the cryptocurrency’s price after Trump’s win.

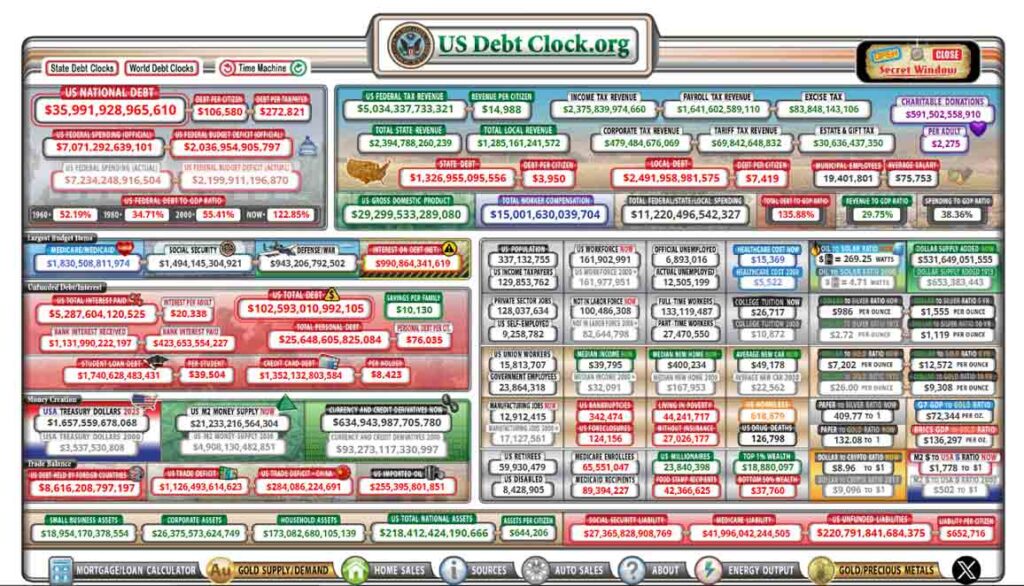

The U.S. national debt is now higher than $35 trillion after the country’s prolonged money printing and inflation.

U.S. officials like Jimmy Patronis and Senator Cynthia Lummis of Wyoming recently introduced solutions to this, including the Bitcoin Strategic Reserve bill

The stock market’s rally after Trump’s victory shows investor enthusiasm for the anticipated “MAGA trade” as investors expect policies like lower taxes, deregulation across sectors, and a generally friendlier environment for business.

Future Implications of Trump’s Win

As Trump prepares to assume office in January 2025, all eyes are on the incoming administration.

This is especially related to the new administration’s effects on traditional markets and emerging digital assets like Bitcoin.

If Trump follows through on the Bitcoin reserve that has been mentioned so severally, the U.S. could join other countries that are starting to add Bitcoin to their balance sheets.

With the increasing calls to reform or dissolve the Federal Reserve, the conversation around central banking will likely become more heated.

Whether this sentiment will materialize into actual change remains to be seen.

However, the growing support for Bitcoin as a hedge against inflation means that the financial landscape will soon change for billionaires and everyone else.

![Top Altcoins in October [2024] You Should Look Out For 19 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)