Banking Giant UBS Unveils Its First Tokenized Investment Fund

In a significant shift for traditional and blockchain finance, UBS Bank has launched a pioneering money market fund on the Ethereum blockchain, branded as the UBS Money Market Investment Fund Token, or uMINT.

UBS’s uMINT is a tokenized and dollar-pegged crypto that its money market fund will use. It combines the benefits of blockchain technology with the stability of traditional financial assets. This aligns with recent trends, as financial giants BlackRock and Fidelity have already introduced blockchain-based money market funds.

This article will discuss concepts such as money market funds, the mechanisms and benefits of tokenization, the role of RWAs in the emerging ecosystem, and why RWAs might be the future for nearly all traditional market assets.

Understanding Money Market Funds (MMFs)

Money market funds are a form of mutual fund that offers a low-risk investment with stability. They invest in high-grade, short-term instruments, which include government securities, commercial paper, and certificates of deposit. Therefore, these funds are highly liquid and relatively safer than other financial instruments.

High Liquidity: MMFs are designed to offer high liquidity so investors can redeem their shares with little loss of value at any time.

Low Risk: As they invest in short-term, high-quality instruments, they are relatively insulated from market volatility, making them a favorite among conservative investors.

Stable Returns: The returns are usually low but predictable. Thus, they provide stable and reliable income for the risk-averse investor.

Traditional investors find MMFs highly attractive, more so in times of economic uncertainty, as they provide liquidity and offer a low-risk profile when retaining better returns than standard bank savings accounts.

Tokenization of Money Market Funds (MMFs)

Money market funds can be tokenized by issuing digital tokens equivalent to shares or units that represent such funds. This is made possible by blockchain technology, which is transparent, secure, and accessible. MMFs would then become available to a wider clientele, particularly to those who prefer the idea of digital money over traditional paper-based processes.

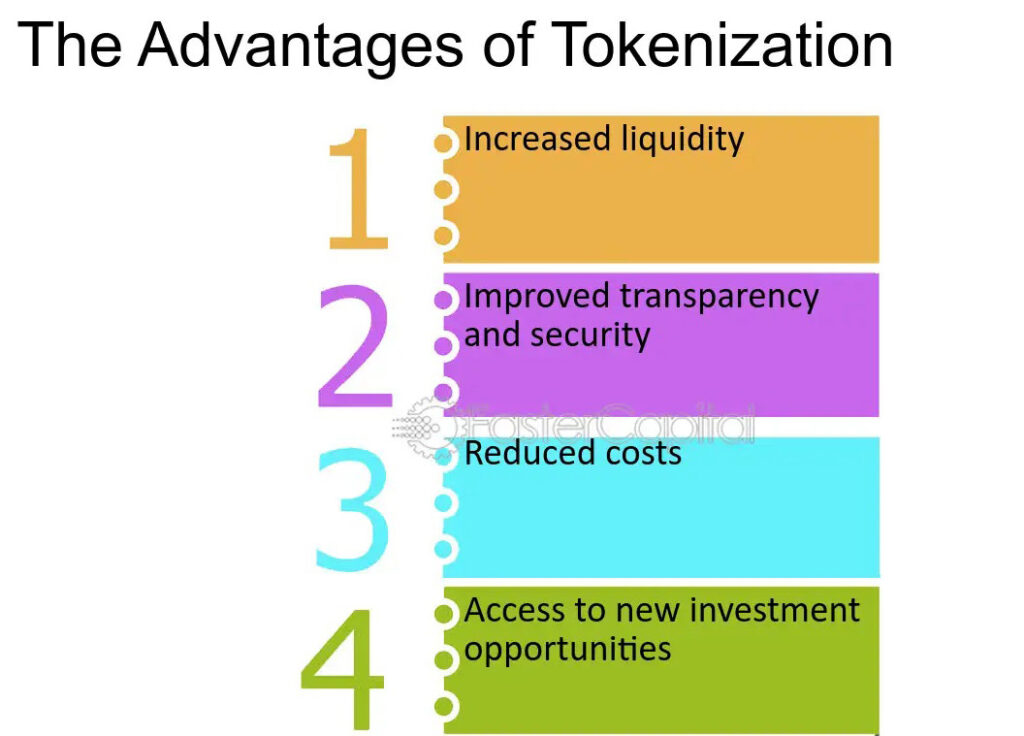

Advantages of Tokenized MMFs

Enhanced Accessibility. The tokenization of MMFs makes investment products more accessible to a global audience, thereby reaching some audiences that could not access such investment products due to regional or regulatory barriers in access.

Fractional Ownership: Tokenization allows fractional ownership of these funds, enabling investors to purchase small portions of MMFs democratizing access to these traditionally large-scale investment products.

Increased Transparency: Blockchain technology ensures that all transactions are publicly verifiable and safe, thus providing investors with better transparency than traditional financial systems.

Increased Liquidity: Because blockchain-based platforms are open at all times of the day, investors can issue or redeem tokens 24/7, which will definitely increase their liquidity.

Reducing Cost: Blockchain will automate and speed up transaction settlements, thereby reducing costs and delays associated with intermediaries.

UBS’s move to tokenize its MMF on Ethereum with the launch of uMINT demonstrates a growing interest among financial institutions in integrating blockchain into their operations. By adopting tokenization, UBS could revolutionize investor access, streamline processes, and reduce costs in managing MMF investments.

How does UBS’s Move Relate to BlackRock and Fidelity?

uMINT from UBS is not the first blockchain-based MMF initiative.

BlackRock has also launched a money market fund on Ethereum but restricted access to capital investors with a high entry threshold of $5 million.

Further, Fidelity has recently presented a blockchain-based MMF offered on the Base blockchain developed by Coinbase for qualified investors only.

What are Real-World Assets (RWAs)?

Real-world assets (RWAs) are physical items or conventional financial instruments that represent digital tokens on a blockchain.

They may be anything from tangible items such as real estate, commodities, and art to securities like bonds and stocks.

RWAs allow blockchain to store and exchange various types of assets that exist outside the digital world and bridge the physical and digital financial ecosystems.

Examples of RWAs:

- Real Estate: It allows for fractional property ownership, which is good for small investors who wish to gain exposure to the real estate market without purchasing an entire property.

- Commodities: Precious metals, oil, and all other commodities. Tokenization can be done for commodities, through which investors can buy digital representations of these assets and trade them more efficiently.

- Securities: Bonds, stocks, and funds like MMFs can be tokenized, giving investors new ways to access traditional financial markets and improve asset liquidity.

Why Rwas Are the Future of Traditional Assets?

The ability of RWAs to transform financial markets from their traditional versions could allow new avenues of liquidity, accessibility, and efficiency. By tokenizing the RWAs, a new generation of investors would have access to markets once deemed inaccessible. This could give more people fractional ownership in asset classes hitherto requiring very high barriers.

Main Benefits of RWA Tokenization

Liquidity Enhancement: Traditionally, illiquid assets, such as property and fine art, become fractionalized and tradable as tokens, making it easier and possible to buy and sell these more frequently.

Cost Efficiency: Removing intermediaries in transactions reduces costs for both issuers and investors. For instance, tokenizing a property would bypass brokerage costs associated with real estate purchases.

Borderless Access: Blockchain technology makes RWAs accessible to a global audience. Investors worldwide can participate in these markets without the usual geographic and regulatory restrictions.

Improved Transparency and Security: All RWA transactions are recorded on a secure, immutable blockchain, making them traceable, which instills trust and reduces the risks of fraud.

It is an innovation that harmonizes the traditional finance system and blockchain technology: the UBS USD Money Market Investment Fund Token, uMINT. By tokenizing money market funds, UBS and other institutions are gradually providing a much more inclusive and efficient financial ecosystem.

The tokenized funds make MMFs accessible and transparent to a larger investor base, thereby emphasizing blockchain’s role in transforming how we interact with traditional financial instruments.

This move by UBS follows the same trend as one set by BlackRock and Fidelity, which implies that real-world assets are most likely the future of most traditional financial assets.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)