What Does Burning Crypto Mean?

What Does Burning Crypto Mean?

The basic idea behind crypto burning is the permanent removal of some percentage of the cryptocurrency from circulation. It is an intentional reduction of supply, and its effect can be widespread on the value and utility of a token.

It may sound ominous, but it plays a crucial role in the tokenomics of some specific cryptocurrencies. Let’s understand it in depth.

Crypto burning refers to sending tokens or coins to an “unspendable” wallet address, also known as a burn address. The tokens received by the burn address can be received but never spent, thereby making the assets stored in it inaccessible. The crypto is taken out of circulation when they are sent to this burn address once and for all. That is like burning paper money-which you can never use again.

The process is transparent and any person can check whether these tokens were burnt. Token burning is a deflationary mechanism that intends to reduce the supply of the cryptocurrency, thereby making it scarce, and theoretically, can drive up the price.

How Does Crypto Burning Work?

Burning crypto isn’t exactly as straightforward as just deleting some digital files. What it means to burn your crypto, even if it sounds very much like taking your analog currencies and setting fire to them, is to send the tokens to a cryptographically designed black hole address that lacks private keys to access any token that has been sent there. No one can spend the tokens in this address because the blockchain does not give access to this address to anyone.

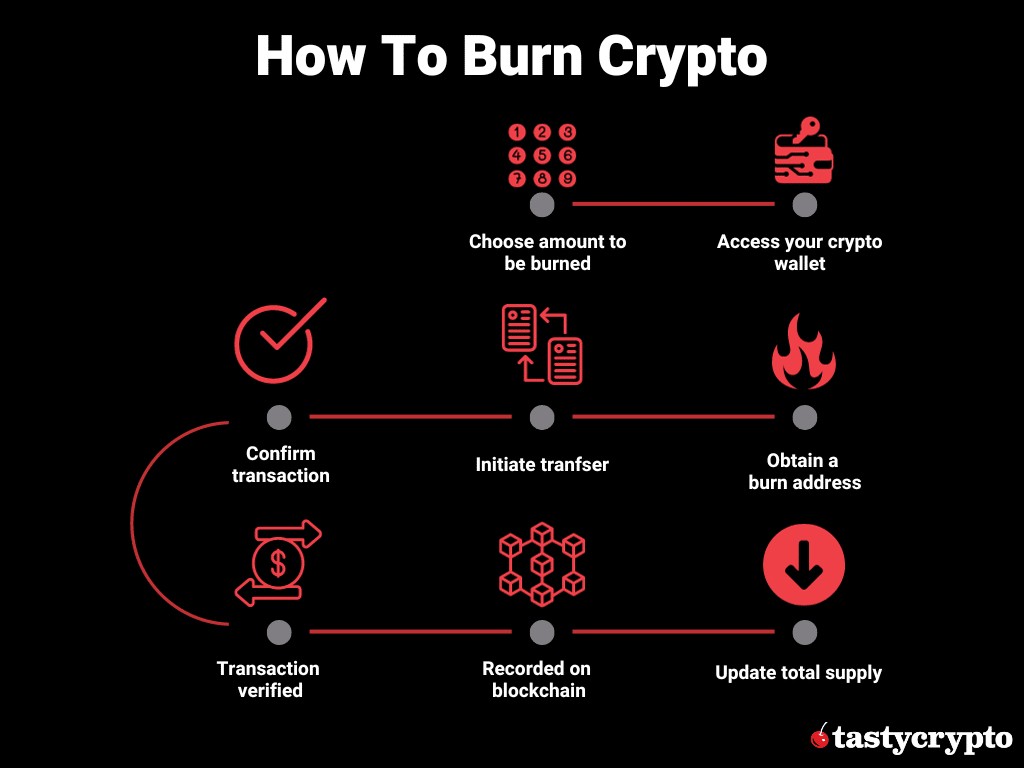

Here is a very simple outline of how a crypto burn transaction works:

- Initiation of Burn: It is the decision of the development team or governance body of the crypto project that burns the tokens.

- Execution: The tokens are sent to a public, unspendable burn address, which no one controls. The process cannot be reverted.

- Blockchain Record: The burn transaction will be recorded on the blockchain as a record to show that the tokens were removed from circulation.

- Supply Reduction: The supply in circulation of the token decreases, hence having a real chance to increase demand for it and a price rise due to reduced supply.

Why Do Projects Burn Cryptocurrency?

- Control of Supply in Circulation: Less supply and constant or increasing demand can see an increase in the price of the token and thus benefit the holders. In a blockchain network, the inflationary approach can be used to handle inflation.

- Incentivizing Holding: This project burns tokens to create a scarcity, which then incites appreciation in the price. The tokens that remain become more valuable, and people don’t want to sell them because it’s too pricey.

- Curbing Oversupply: A host of projects issued a plethora of tokens or coins at one time. Burning some of the extra tokens will help bring the supply back into a more controllable ratio.

Network Security and Governance:

Some blockchain networks view token burning as part of a governance mechanism. This could be in the form of token burning for voting over network upgrades or as a way to secure the network through settling fees from transactions in the blockchain, and then such fees are burnt.

Token Burn Mechanisms: Examples in action

Binance Coin (BNB)

One of the most recognizable includes Binance with regular token burns on its BNB. Through 20% of profits every quarter, Binance repurchases and burns BNB tokens. It aims to burn 100 million BNB, which in turn represents 50% of its total supply. It is a deflationary measure to increase the value of the token over time.

Ethereum (ETH):

EIP-1559 was activated in the year 2021, and it implemented the burning mechanism for transaction fees. With every new transaction fee, part of that is burned instead of being given to the miners. So, in a way, this made ETH a deflationary asset as its supply is decreasing over time. The goal behind doing this would be to offset the inflation and scarcity. So with all this, time will surely favor long-term holders.

Shiba Inu (SHIB):

Another meme coin that in theory has adopted the concept of burning. The community with an extremely high supply of SHIB sometimes burns tokens to reduce the circulating supply in the hopes that it will increase the value of the token in the future.

Impact of Crypto Burning on Supply and Prices

Crypto burning has positive effects; however, it also carries certain risks and criticisms:

Manipulation of Market:

Critics say sometimes, they present an opportunity to play the market manipulation game through token burns. Projects will burn some tokens inflating the value of the cryptocurrency for short-term benefits, misguiding the investors in the process.

Unsustainability of Price Growth:

A token burn does not guarantee an increase in price. Many factors outside of token burning-baseline market demand, utility, and even general mood-will decide the worth of a token. Long-term price growth might not be sustainable in the case of token burning.

Lower Circulating Supply:

Burning also decreases the circulating supply and therefore reduces the liquidity in the marketplace. This can lead to a situation where large trades are hard to execute without causing a drastic price movement.

Security Concern:

It is also criticized that burning large amounts of tokens may affect the security or decentralization of any network as ownership of a network is concentrated in fewer people’s hands, thus leaving potential security voids.

Conclusion

The process of crypto burning is quite interesting in that it permanently retires tokens out of circulation. It has several goals, from ensuring scarcity to securing networks. Of course, burning should positively contribute to the price of the token; however, it is highly risky. The cryptocurrency market will probably keep evolving, and burning is likely to remain a topic of discussion and experiments.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)