What Is Tornado Cash?

The cryptocurrency world is rapidly growing, giving birth to both innovation and challenges. Of all the hot topics within this realm, privacy is perhaps one of the most discussed and one that is the most sought by protagonists.

They argue that transparency within blockchain networks creates a paradox with them: being decentralized and having fully open-readable ledgers but leaving users’ transactions open to the public view.

In this scenario, Tornado Cash emerges both as a utility to restore privacy and also throws significant questions about over-regulation, security, and ethics. Here, in this blog post, we will look at what Tornado Cash is, how it works, and why it has been causing such hype.

Tornado Cash is a decentralized, non-custodial privacy solution built upon the Ethereum blockchain. It’s a mixing service, or more technically, a cryptocurrency tumbler, which helps users hide the link between their wallet of crypto and history of transactions.

Even though blockchain transparency is highly valued and appreciated for accountability, it can betray identities at the same time if one is concerned about issues of privacy as anyone can trace the source as well as the destination of any transaction.

Tornado Cash is a clever contract designed to anonymize people using the Ethereum platform, thereby breaking the link between wallet addresses and transactions that might otherwise be traced.

Mixing services have a pretty long history. Really, they were invented when cryptocurrencies first emerged, but Tornado Cash is unique for two reasons: it’s decentralized and has avoided some of the nasty aspects of traditional mixers, which require users to rely on an operator not to tamper with their funds or data.

Tornado Cash works entirely based on the smart contract that underlies it and so is trustless and censorship-resistant.

How Does Tornado Cash Work?

Basically, Tornado Cash employs zero-knowledge proofs, specifically zk-SNARKs, or Zero-Knowledge Succinct Non-Interactive Argument of Knowledge. It’s a technology that lets someone prove they know specific information (such as a private key), without revealing that information itself.

Here’s a really simple description of how Tornado Cash works:

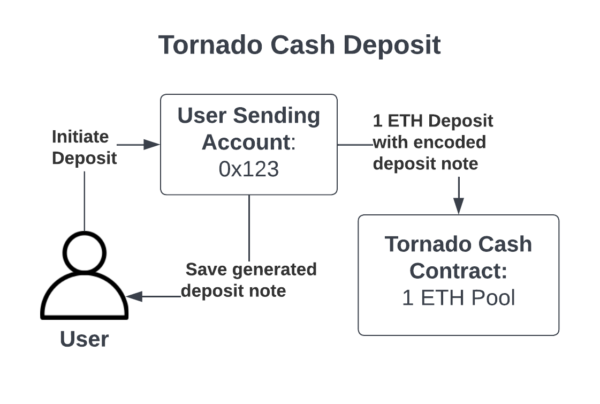

- Deposit: A user sends a given amount of Ethereum or an ERC-20 token, for example, DAI or USDC, to the smart contract of Tornado Cash. This is done at several mixing pools. To send 1 ETH, a user will need to send it to the 1 ETH mixing pool. The pools are designed only for a specific denomination, preventing re-linking through partial withdrawals.

- Note Generation: On making a deposit, the Tornado Cash generates a secret note. This basically acts as proof of deposit. The importance is there, for later use to withdraw the funds anonymously.

- Mixing Process after the deposit: The ETH or token deposited becomes mixed up with others in a pool deposited into the pool. It breaks the chain of transactions between the sender and the recipient. The longer the coins spend within the pool, the more complex it is to track.

- Withdrawing: The user will have to surrender the secret note to the Tornado Cash smart contract in withdrawal. The zk-SNARK proof will guarantee the proper withdrawal amount without exposing the original address or any details regarding the deposit. Funds received will then be sent to a new wallet address, almost impossible to track the original deposit address with the withdrawal address.

Why is Tornado Cash Controversial?

Although Tornado Cash, by providing users with a legitimate way to maintain the privacy of financial information, attracted the attention of more regulatory bodies and law enforcement; on the other hand, it enables this very same technology for illegal financial activities such as money laundering and tax fraud, along with funding illegal activities.

In August of 2022, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) said it’s sanctioning the virtual currency service Tornado Cash. It alleged that the service had facilitated billions of dollars in illicit transactions, some of which involved the North Korean hacker group Lazarus. The Treasury said that it believes more than $7 billion in cryptocurrencies have been laundered through the service since its inception in 2019.

A huge debate prevailed in the crypto community. On the other hand, privacy advocates contend that services like Tornado Cash are important in protecting the anonymity of users as anonymity in itself is one premise of decentralization and financial sovereignty.

They view financial privacy as a human right, and just because a tool can be used for illegal purposes, this does not necessarily mean that it should be banned or censored. Consider, for example, the fiat currency, U.S. dollar, where most illegal transactions are done in it, but it is not prohibited.

The regulators have said that if regulated, there would appear overnight instruments like Tornado Cash as places for crime. They cannot comprehend how there has to be a connection between privacy and the level of DeFi compliance with AML/KYC rules.

Decentralization and Governance

One of its standout features is decentralized governance-a very unique quality. Dealing with a decentralized autonomous organization, the protocol has nothing to do with a central entity but is instead governed through a community of token holders. In this way, the ‘fair enough’ perspective of decentralization is reinforced.

This, however, makes regulatory action complicated. When OFAC sanctioned Tornado Cash, it became clear that sanctioning a smart contract is not akin to targeting a centralized entity.

Sanctioning a smart contract questions, in the light of how government has to approach decentralized technologies. In the absence of any central figure to whom one may hold accountable, should the technology be restricted? What does it mean for future generations of dApps?

The Future of Privacy in Crypto

Tornado Cash sits at the nexus of privacy, technology, and regulation. Its story reflects broader tensions in the cryptocurrency space: how to maintain decentralization and privacy while complying with laws designed to prevent financial crime. It is a battle likely to intensify as more privacy-centric tools emerge in the DeFi ecosystem.

Now, Tornado Cash lives on but at a price. Its DAO is active, and the sanctions notwithstanding, users continue to interface with the protocol. So far, questions begin to surface in terms of whether sanctions will operate in decentralized systems or whether similar tools will be subject to regulatory challenges down the line.

Conclusion

Tornado Cash is a revolutionary means of restoring privacy in the crypto space; meanwhile, malicious actors may misuse it, which placed it squarely in the crosshairs of regulators. Its decentralized nature makes it difficult to control or shut down, opening up future legal battles.

To be frank, Tornado Cash forces the crypto user and regulator to rethink the balance between privacy and innovation with security. Are we now seeing a champion for greater privacy but on the other hand, trigger much tighter restrictions?

Only time will tell.

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)