Key Takeaways

- The White House crypto summit went as planned this week, with many industry leaders in attendance.

- One of these was Strategy Chairman Michael Saylor, who outlined a plan for the US to achieve financial dominance through Bitcoin (BTC).

- Saylor believes that Bitcoin and the strategic reserve bill can be used to generate up to $81 trillion in wealth by 2045.

- The Strategy Chairman believes that BTC is the key to the national financial dominance, and rival nations will take up the baton if the US doesn’t.

- The question now is: will the U.S. move fast enough to seize this trillion-dollar opportunity?

Strategy Chairman Michael Saylor took the stage at the White House Digital Asset Summit this week.

According to Saylor, Bitcoin could generate $60-100 trillion in wealth for the United States over the next decade.

Saylor made this statement while addressing the audience that included US President Donald Trump, government officials, task force members, and other financial executives.

Saylor drew out a detailed strategy that he believes could help to shape the US financial system, especially with BTC at its core.

Here are all the details.

The Strategic Bitcoin Reserve

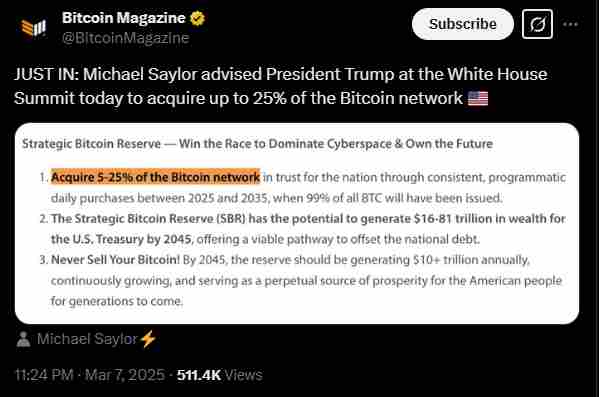

The establishment of the US’ strategic Bitcoin reserve (SBR) was at the heart of Saylor’s strategy.

His points were straightforward and went like this:

If the US government starts to accumulate BTC now, the national treasury could generate up to $81 trillion in wealth by 2045—without having to sell a single Bitcoin.

Moreover, by 2035, Saylor believes that with 99% of all Bitcoin already mined, the reserve could be generating over $10 trillion per year.

Saylor urged the US to implement a systematic, daily Bitcoin purchase strategy.

This strategy could help it control as much as 5-25% of the total Bitcoin supply.

In essence, with the cryptocurrency’s fixed supply and demand, such a move would turn the US into an unbeatable powerhouse.

“The race to dominate cyberspace has already started. If we don’t lead, someone else will,” he warned.

The Battle for Financial Supremacy

China has already moved strongly into the digital finance space, and Saylor stressed that the US must act fast or risk losing its dominance.

He made it clear that the US should never sell its holdings and pointed out the “Buy. Hold. Repeat” strategy.

This means that as Bitcoin’s scarcity increases, demand will surge and its price will soar.

If the US indeed controls this targeted 5-25% supply of the token, it might turn into a financial goldmine for the U.S.

During the meeting, Trump (who had already embraced Bitcoin as part of his broader economic strategy) seemed receptive to the idea.

His administration has already begun implementing crypto-friendly policies for the US in a bid to encourage innovation and boost investment within the space.

A New Financial System Built Around Bitcoin

More than simply hoarding Bitcoin, Saylor’s vision includes a complete transformation of the US financial system.

He outlined a framework that includes crypto into the traditional markets and broke digital assets down into four main categories.

- Digital Tokens: These assets include corporate-backed assets that allow companies to raise trillions through tokenized securities.

- Digital Securities: These include tokenized stocks, bonds, and ETFs traded on 24/7 global markets (without intermediaries).

- Digital Currencies: U.S. dollar-backed stablecoins issued by American firms to maintain financial dominance.

- Digital Commodities: Bitcoin itself, bought as a store of wealth and long-term value.

Saylor believes that this framework could be the key to adding $60-100 trillion to the U.S. economy by the end of the decade.

He also believes that Bitcoin alone could contribute as much as $20 trillion to this figure.

Removing Barriers to Crypto Growth

For this vision to succeed, Saylor pointed out the harsh crypto policies that have been the norm in the US crypto space.

He emphasized that for this crypto vision to succeed, these policies must end immediately.

Saylor pointed out a few recommendations to achieving this, including ending unfair taxation on Bitcoin mining and transactions, forcing banks to accept crypto businesses (which he called a national security risk), allowing U.S. companies to issue digital assets, and ensuring free movement of digital assets.

Saylor emphasized that if the US continues to lead in terms of Bitcoin adoption, it will attract capital while creating jobs and securing the future.

How Did Bitcoin React?

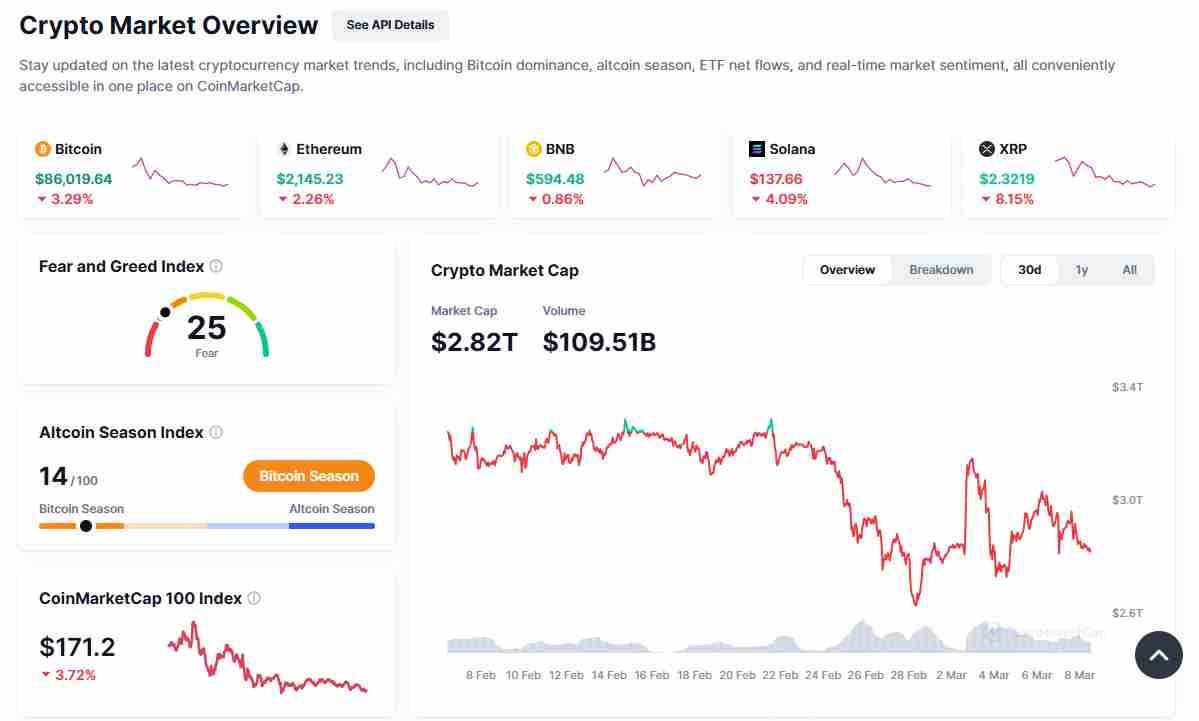

The crypto market hasn’t reacted very bullishly to the news lately, with Bitcoin currently down by around 3.5% at a current price of $85,928.

Other cryptocurrencies like Ethereum, Solana, XRP, Dogecoin, and Cardano have also stepped back with declines between 4% to 10%.

XRP and Cardano were particularly hard, with a 9% decline on the daily timeframe.

The total crypto market also lost more than 3.5% of its total capitalization, with the fear and greed index hitting extreme fear levels around the 25/100 mark.

Ethereum has lost most of its market dominance so far and now holds less than 10% dominance compared to Bitcoin’s 60.5%.

Overall, Saylor’s plans extend far beyond economic growth. The Strategy Chairman sees Bitcoin as a major asset in the global power dynamics.

He warned that if the US fails to take control, rival nations like China and Russia could take advantage of the situation and use Bitcoin to weaken the US’ financial influence.

Overall, the White House summit made it clear that the battle for crypto dominance has already begun.

With Trump now championing Bitcoin and Saylor drawing out a map forward, the question now is…will the U.S. move fast enough to seize this trillion-dollar opportunity?